Markets vs. central banks

Could cryptocurrencies one day bring down the banking system? These decentralized technologies have already shown the potential for disrupting finance, which craves a faster, cheaper, and freer system. If people choose control over their money and identities over security, the fears of financial authorities may be realized.

In a nutshell

- The crypto boom is threatening conventional finance

- Covid-19 has revived discontent with financial authorities

- Central banks and regulators will not stand idly by

Could cryptocurrencies bring down the banking system – and, with it, the authorities who oversee it? Two years ago, such a question would have made central bankers laugh.

It no longer does. During a September Eurofi conference in Ljubljana, seasoned European policymaker Benoit Coeure laid out an alarming scenario: “The financial system is shifting under our feet.” In a speech intended above all as a wake-up call for financial supervisors, the French economist insisted that “central banks have to act while the current system is still in place – and to act now.”

Unforeseen obsolescence

The centralized financial system as we know it could in fact disappear. Not in a tragic fight to the death, nor following a systemic collapse at a larger scale than the one that triggered the 2008 banking crisis. Rather, this time, the traditional banking system may be silently pushed to the margins after having become inadequate, irrelevant, and outdated – in other words, incapable of adapting to a drastically changing world.

What worries Mr. Coeure most is the crushing technological superiority of decentralized cryptocurrencies, which – after only a few years in existence – have proved they have the potential to disrupt finance.

The former European Central Bank (ECB) executive board member is no tech fearmonger. Since 2020, as the chair of the Innovation Hub at the Basel-based Bank of International Settlements (BIS), he has been on a mission to help policymakers and technocrats around the world develop central bank digital currencies (CBDCs).

The ex-central banker is convinced that CBDCs (i.e., digital versions of fiat currencies) are the only option central banks have today if they want to stay in the game – let alone to maintain their leading role in the financial system. The problem, Mr. Coeure recognizes, is that CBCDs will take years to be rolled out, while privately issued digital assets and stablecoins are already there.

Dangerous animals

Meanwhile, there are several thousand cryptocurrencies in existence; the top 20 make up about 90 percent of the market.

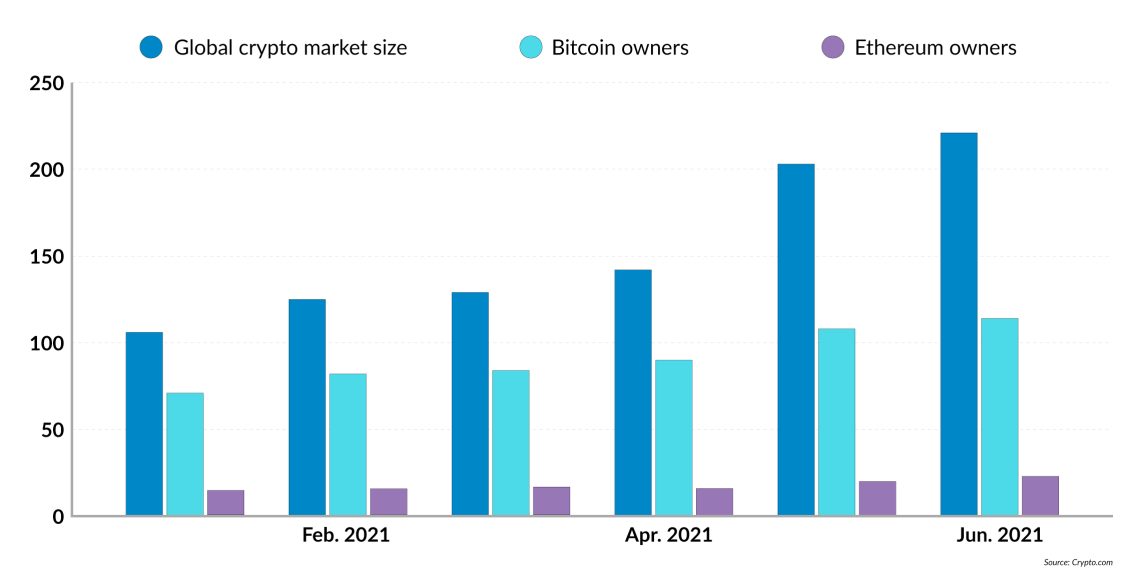

In spite of extreme price fluctuations of the top cryptocurrencies since their inception, more and more people are tempted to jump ahead. As of June 2021, there were already 221 million users worldwide, including 120 million using bitcoin alone. This boom has only just begun.

The pandemic played an important part in what appears to be a bandwagon effect. The hype surrounding crypto – or to be more precise, sugarcoated marketing playing down people’s legitimate fears and concerns – has fueled investors’ optimism bias: the overconfident belief, common to all gamblers, that they are going to win rather than lose big.

Despite their growing popularity, bitcoin and other cryptocurrencies are still far from being a conventional way to invest money. Investors are often blind to the fact that bitcoin, after all, has no intrinsic (i.e., real) value. Normally, investments are made in view of future income. This is not the case for bitcoin; as one financial analyst put it, “one cannot invest in BTC, one can only speculate in BTC.”

It is no coincidence that the pandemic has revived markets’ discontent with monetary authorities.

Stablecoins, for their part, appear less volatile and therefore less exposed to the risk of a brutal price crash. In contrast to bitcoin, they are tied to the value of fiat money (usually the United States dollar) or any other asset with real value (such as gold, silver, oil). Still, it remains difficult for the inexperienced investor to learn his or her way through a seemingly opaque and chaotic market.

Fabio Panetta, the Italian economist who replaced Benoit Coeure at the ECB’s executive board in 2020, has used harsh words to describe what he even refuses to call “currencies.” “Crypto-assets are very dangerous animals,” he said.

He is not wrong; but does it make sense to think that such high-risk assets could be the future of money? Is it really conceivable that the banking system, central bank money and their powerful guarantors of last resort – states and central banks — could be swept away? Perhaps only if a problem emerged, shaking the markets’ perceptions of central bank money and policy.

Broken trust

Indeed, such a problem may have come to light in 2008. Bitcoin’s inception in 2009 is often viewed as an act of defiance against the centralized banking system. The global financial crisis revealed that misconduct had for long become the norm in the banking industry, and that much of the regulatory frameworks in place had been a failure.

To repair those frameworks, central banks were given new assignments. Not only did they become intransigent banking supervisors and regulators; they aspired to become a new kind of fiscal power, in command of steering the economies in times of crises and beyond.

The ECB is a case in point. It stretched to breaking point its original, narrowly defined mandate of maintaining price stability in the eurozone. Unlike other central banks, it had to face a sovereign debt crisis – which, in 2012, almost brought down the EU’s common currency. Even if markets’ trust in sovereign money could be restored (through then-President Mario Draghi’s famous commitment to do “whatever it takes” to save the euro), it never fully recovered.

It is no coincidence that the outbreak of the Covid-19 pandemic and its host of authoritarian policy responses (previously unseen in democratic nations) revived markets’ discontent with monetary authorities. For instance, savers increasingly perceive the persistently low (or sometimes even negative) interest rates as an illegitimate tax on their deposits. For long, they meekly accepted the creeping expropriation as a necessary (and temporary) evil in times of crises. Their tolerance level is dropping as they suspect that central banks will monetize part of governments’ colossal Covid debt through inflation.

With inflation on the rise and no end to financial repression in sight, crypto attracts even low-risk-profile investors. Some adopt a devil-may-care attitude, weighing the probability of losing (but also gaining) money in a gambling game against the certainty of losing in the fiat system. In a way, they send a message to central banks: “you’ve gone too far.”

Freedom call

What the crypto rush reveals above all is that markets crave alternative finance. They want it to be faster, cheaper, more rewarding – and, above all, freer.

Safety is important too. But, as revealed by the ECB’s recent public consultation on a digital euro, privacy is valued very highly by customers these days. Maybe the stringent transparency requirements imposed by the current banking regulations – obsessed with money laundering, tax evasion and financing of terrorism – have simply become too intrusive for the taste of many citizens.

Crypto entrepreneurs have heard the message. As one prosperous start-up advertises its financial offering: “Our goal is to disrupt the financial industry, one happy user at a time, and introduce financial freedom through crypto.”

Unbank the world

Newcomers have recently challenged commercial banks’ business models by creating open-source protocols that replicate existing financial instruments within a decentralized architecture. Their blockchain- and smart contract-based services promise to revolutionize payments, savings, lending, trading, asset management, derivatives, and insurance.

The pioneers of decentralized finance (DeFi) share a common goal: knock off their pedestal the middlemen and gatekeepers that have domineered centralized finance so far. Today, DeFi is among the fastest-growing sectors in the crypto world. According to one of the players involved, its market size is already measured in the trillions.

Facts & figures

Yet it may still only be in its infancy. For the moment, DeFi is a playground essentially for experienced investors, with knowledge barriers remaining high.

Technology might soon render possible a large-scale investor revolution. Once access to DeFi gets easier, retail bankers might have a real reason to worry. DeFi markets could attract virtually anyone who has a smartphone and an internet connection.

Moreover, 1.7 billion adults worldwide are excluded from the traditional banking sector. DeFi could provide microfinance solutions to those unbanked, usually low-income individuals, opening up new prospects. In the world of DeFi, no credit amount is too small to be granted. Financing opportunities might arise that so far would have been unthinkable.

One can only imagine the positive impact on developing countries – not to mention those where authoritarian or irresponsible governments destroy the value of national currencies and the wealth of citizens.

Bridge builders

So far, DeFi is largely unregulated. Permissionless and censorship-resistant ecosystems enable perfectly anonymous users to interact on peer-to-peer trading platforms – at their own risk. None of the compliance procedures or mandatory disclosure requirements at the heart of today’s banking system, such as Know Your Customer (KYC) or Anti-Money Laundering (AML), need to be applied in those settings.

This scares off many potential users, notably in Western countries, where regulation is highly valued. Some companies are currently exploring a new market niche by providing crypto-services to those who want to take a safer road, preferring to turn to “regulated” institutions that trade and store crypto-assets on their behalf.

Market leaders Celsius and BlockFi present themselves as “centralized” blockchain-based companies, which perform KYC and comply with AML. In a way, their platforms create a bank-like environment meant to give crypto-beginners a sense of security – albeit a distorted one, as the companies’ accounts have been hacked more than once.

In order to provide investors with more secure and easy access to cryptoassets, other DeFi platforms seek to bridge the gap between blockchain-based finance and traditional capital markets. For example, Defi Technologies Inc. offers so-called digital-asset-exchange-traded-products (ETPs), listed on regulated stock exchanges.

Central banks and regulators will not stand idly by while decentralized finance cuts the ground from under their feet.

“Crypto-banks” and digital asset investment firms currently have the wind in their sails. They are the ones that could precipitate society’s move to digital finance.

The question is, for how long? Sooner or later, big incumbent banks might challenge them, building blockchain infrastructures of their own. But only a few have so far been able to get a foot into crypto, let alone disrupt the disrupters.

A recent study revealed a widening of the gap between leading banking institutions and those lagging behind. It looks as though crypto is already sorting out winners from losers.

Scenarios

Central banks and regulators will not stand idly by while decentralized finance cuts the ground from under their feet. They will come up with new regulations.

Already, in September 2020, the European Commission published a proposal for a regulation of the “Markets in Crypto-Assets” (MiCA). The document was drafted largely in reaction to Facebook’s Libra announcement, perceived as a threat to national currencies. In the meantime, Libra (rebranded Diem) was watered down to a simple dollar-backed stablecoin and is nowhere close to being issued. DeFi, on the other hand, gained momentum precisely in 2020-2021 – and is at risk of becoming MiCA’s first collateral damage.

Fortunately or not, MiCA is expected to enter into force only in late 2024. By then, many of its provisions may be obsolete. Compared to regulators, crypto innovators move at lightspeed.

Policymakers are “increasingly worried about being left behind,” Benoit Coeure admitted during a conference in Geneva. Could CBDCs get them back into the race? Mr. Coeure seems skeptical: “The time has passed for central banks to get going,” he said in Ljubljana.

A 2021 BIS study confirmed that even though most central banks have a keen interest in CBDCs (and some already “experiment” with the technology), only a handful are actually running pilot programs.

The People’s Bank of China is a front-runner. The ECB is among those that still “investigate;” it recently stated it wanted to get “ready” to launch a digital euro, but will not necessarily do so.

A host of technical (notably security-related) issues remain unsolved. The potential disintermediation of banks is another tricky problem. For the banking sector, a retail CBDC – if not well managed – could become a threat far greater than DeFi.

Finally, there is the question of why consumers would prefer CBDCs to decentralized cryptocurrencies.

The likes of Mr. Coeure hope that if privacy and safety principles were to rule, central banks will come out on top. The precise opposite might happen: the fact that digital cash gives central banks the power to track end-users’ spending in real time may in fact have a deterrent effect. Citizens today may be used to a high level of surveillance, but CBDCs could become the straw that breaks the camel’s back.

At some point, people might want to regain control over their money and identities. Many will desert centralized finance and turn to privacy-protecting DeFi platforms. Self-sovereign identity at consumer scale could become a pillar of the future financial landscape.