China’s future under Xiconomics

President Xi Jinping seeks growth and national self-sufficiency by strengthening state enterprises while wooing selective private foreign investment.

In a nutshell

- China’s underlying strengths may keep its economy growing at 4 percent annually

- From the zero-Covid policy to a real estate crisis, blunders have done great damage

- Self-sufficiency is threatened by American-led bans on key technology transfers

In his report to the 20th Party Congress, Chinese President Xi Jinping mentioned the word “security” 91 times. His concept refers not only to military and geopolitics but also, most importantly, to economic and technological security.

The start of his third term in October signaled that Mr. Xi has, for the time being, resolved his own political security within the party. Factional struggles are no longer a direct threat to his power. His uncompromising politics were evident from the incident involving ex-President Hu Jintao, who was abruptly escorted out of the 20th Party Congress by security officials. As for the composition of the Politburo Standing Committee, President Xi handpicked all members and thus they will be subservient.

Many Western observers have predicted that China’s economy – the world’s second-largest with gross domestic product estimated to be $15 trillion this year – will fare worse in the coming years. However, it is likely that the Chinese economy will keep growing, although at a much slower pace than the spectacular 9 percent average annual expansion from 1980-2020.

The essence of Xiconomics

Many of the recent economic security problems facing the Chinese Communist Party are due to President Xi’s unwise moves, including his zero-Covid policies. The strict Covid lockdowns not only sparked mass protests. Among the angry demonstrators in Shanghai there was even a demand to remove Mr. Xi from power.

Mr. Xi’s economic policies have also triggered a real estate crisis, weak consumption, high youth unemployment (20 percent for those aged 16-24) and exploitation of private enterprises. A huge drop in local government revenues adds to the strain.

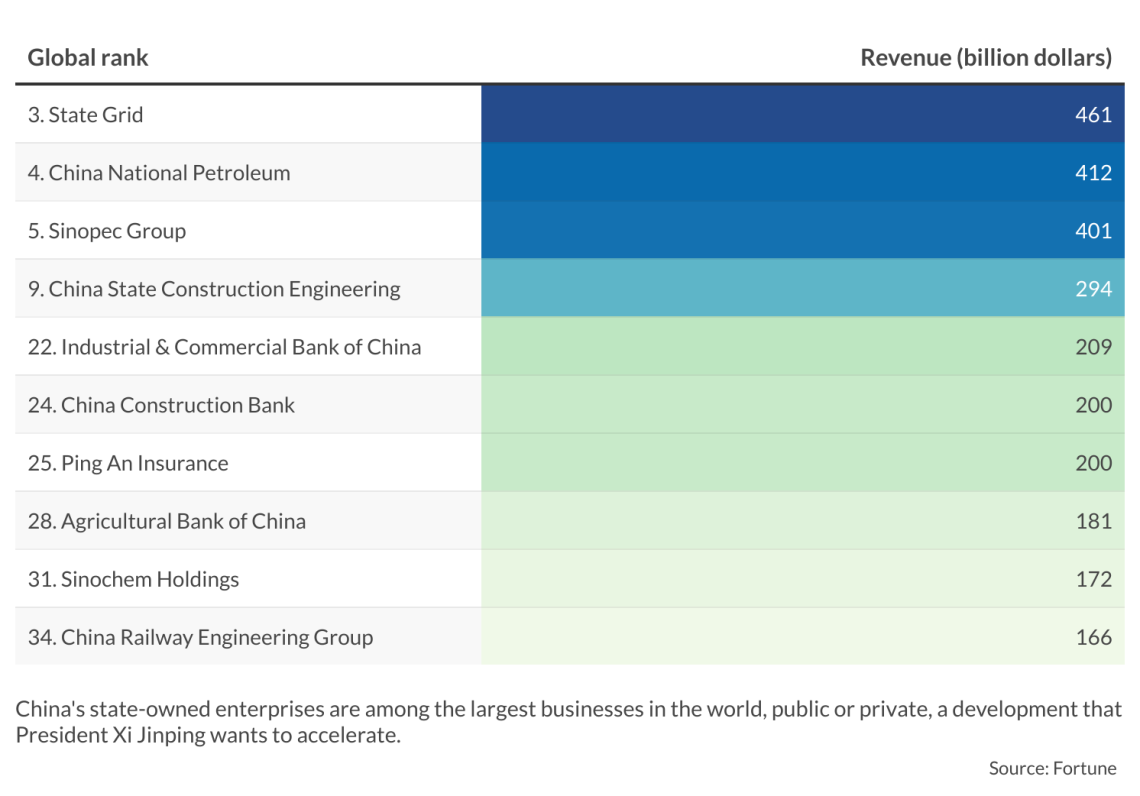

An important feature of President Xi’s policies (hereafter Xiconomics) is ambition based on his understanding of socialism. For example, he explicitly emphasizes the need to make state-owned enterprises larger and stronger, as pillars of socialist economic security, as well as an important cornerstone of China’s response to global economic shocks.

Economic policy is up to President Xi alone.

Some of China’s economic problems are also a result of Mr. Xi’s contentious interactions with the West, particularly the United States. Events arising from his policies have undermined trust and deepened tensions between China and the West. This is exemplified by rigorous U.S. restrictions on China’s access to high-value semiconductors.

After the 20th Party Congress, economic policy is up to President Xi alone. To chart the direction of China’s economy over the next five to 10 years, an understanding of Xiconomics is required.

Some Western observers assert that Mr. Xi will always put politics ahead of the economy. But they forget that since President Deng Xiaoping, the economy is the main basis of the CCP’s legitimacy, and this is no exception for the current president. For this reason, Mr. Xi will do everything in his power to achieve two goals: improve “domestic circulation” and ensure “international circulation.”

Domestic circulation

By domestic circulation, Mr. Xi means boosting the domestic economy. The Chinese leader has long been seeking to strengthen state-owned enterprises (SOEs) at the expense of private enterprises. National champions in key sectors are selected and bred. SOEs should not only enhance their own resilience and competitiveness but also play dominant roles in the economy. This concentration of state power is well underway. Statistics show that 68 percent of the total assets of listed companies belong to central SOEs, and 86 percent of the profits are attributed to central SOEs.

Mr. Xi has underscored the importance of China achieving self-reliance in science and technology.

President Xi’s “mixed reform” is really meant to help SOEs return to monopoly status. In 2003, 196 central SOEs were registered by the State-Owned Assets Supervision and Administration Commission. In 2012, the number was reduced to 117 and now 96 central SOEs are left, but their size is much bigger than ever. Among them, 49 have been listed in the World Top 500 this year.

Another feature of domestic circulation is strengthening China’s technological competitiveness. Mr. Xi has underscored the importance of China achieving self-reliance in science and technology, a goal he repeated at the 20th Party Congress. Since many technology issues are also national security issues, the CCP will focus more than ever on achieving a breakthrough in overcoming obstacles imposed by the West, particularly the U.S. Issues such as securing the supply of microchips have become the highest priority. No wonder the Ministry of Information Technology gathered chip companies to an emergency meeting right after the 20th Party Congress.

By the same token, some baits are used to attract foreign capital, especially in the high-tech sector, to enhance China’s competitiveness. In the first three quarters of this year, investment in high-tech industries grew by an impressive 20.2 percent year-on-year. Of course, it is still a big unknown whether China will be able to reach its goals, such as 70 percent chip self-sufficiency by 2025, compared to 30 percent in 2019. The third aspect of domestic circulation is to enhance consumption capacity. About 70 percent of China’s household wealth is tied to real estate, meaning that this issue is directly related to consumption. China’s real estate sector, which once contributed a quarter of China’s output for more than a decade, is on a downward spiral. Falling home prices have left buyers struggling to pay mortgages on properties worth less than what they owe. This has forced President Xi to loosen purchase restrictions in some cities. The boom days of real estate are over, but the CCP can at least avoid a collapse.

Facts & figures

International circulation

President Xi is not exclusively concerned with domestic circulation. Improving international circulation will also directly help domestic circulation.

This concept has two aspects. One is to create a better environment within China to retain valued Western companies while luring new foreign capital, particularly in projects with high technology and a high potential for value-added production. In the next five years, China will focus on luring fresh investment to break the external siege aimed at containing China. One approach is to encourage foreign investors to set up research and development (R&D) centers in China.

The National Development and Reform Commission and six other departments recently announced the “15 Articles for Stabilizing Foreign Investment,” vowing to improve the environment. In addition to attracting technology-rich investments, the current energy crisis in Europe may prompt energy-intensive companies such as steel, fertilizer and battery producers to move their operations out of Europe. China is ready to absorb them.

Unlike previous openings to the world, Mr. Xi’s new shift will not harm his drive to make his favorite SOEs more competitive. By creating a de facto monopoly of SOEs in the domestic market, foreign companies won’t be able to get much market share in critical sectors. China’s private enterprises also must reconcile themselves to second-class status.

Another aspect of international circulation is trade, including the Belt and Road Initiative and the massive infrastructure investments that are being made by China around the world. Beijing believes that China is not suffering from the energy crisis as much as Europe, while soaring commodity prices in Western and developing countries will inevitably lead to good opportunities for Chinese exports, given Beijing’s deliberate efforts to keep costs (wages, energy) down. Today in Guangdong, the most economically developed province, salaries of part-time workers have regressed to those seen 20 years ago, with hourly wages of only 9 yuan ($1.26) or less. In other words, workers are the victims of China’s export industry.

But not even Mr. Xi sticks to theory consistently. In the current downturn, he is forced to sacrifice part of his ideology in hopes of achieving an economic breakthrough.

End of zero-Covid

Shortly before the recent nationwide protests, Mr. Xi intended to exit his zero-Covid policy because it conflicted with the double circulation efforts. Wang Huning, the president’s close associate, is believed to be leading this work. Mr. Xi intended incremental change. But the protest movement greatly accelerated the pace of the easing of restrictions. Regardless of uncertainties, the Chinese government intends to return to normality in everyday life by the middle of next year.

Xi’s Xiconomics team

For President Xi’s team, namely his Standing Committee of the Politburo, reviving the economy has become the highest priority. The performance of key figures other than Mr. Xi deserves attention. Take Li Qiang, who is set to become premier next March. When governing Shanghai, Mr. Li maintained close ties with tech giants, including Jack Ma, founder of Alibaba. During the Covid outbreak, he was also one of the few senior officials who supported the use of a Western-developed mRNA vaccine in China instead of a domestically produced one despite President Xi’s initial opposition. Mr. Xi’s relaxation on the use of German vaccines, announced during Chancellor Olaf Scholz’s recent visit, implies acceptance of Mr. Li’s proposal. Also, while in Shanghai, Mr. Li presided over several key foreign investment projects from such companies as Tesla, which spent $2 billion to build a factory in Shanghai that the automaker wholly owns, a rare concession to the norm of joint ownership with the state. All these factors indicate Mr. Li will likely combine business knowledge with the ability to align with President Xi on key policies.

Scenarios

China’s gross domestic product grew 3.9 percent on an annual basis in the third quarter of this year. If this figure is reliable, it suggests that China’s economy is still doing better than many expected. Nevertheless, the rigorous zero-Covid policy has depleted the financial resources of local governments. And the country urgently needs a boost. For this purpose, the Ministry of Finance issued in December 750 billion yuan in special treasury bonds. It is expected that the Chinese government will also launch other major stimulus measures next year. Knowing that China’s domestic consumption won’t be revived quickly, the export-oriented provinces are now fiercely exploring markets abroad.

In the best-case scenario, China may achieve technological breakthroughs and self-sufficiency in the next five years, so that growth of around 4-5 percent annually can take place. Big foreign companies and China’s SOEs will be major driving forces in keeping the country’s manufacturing sector strong. China’s domestic consumption should return to pre-Covid levels within two years.

In the worst-case scenario, economic problems will eventually pile up, regardless of a temporary rebound next year, leading to long-term stagnation. The gloomy global economy due to the energy crisis and Russia’s war in Ukraine will very likely further harm China’s economy. Thus, a Taiwan war could then become an optimal distraction for Mr. Xi. Out of frustration with state policy, about 10,000 wealthy Chinese are seeking to leave China. If they succeed in emigrating, they will take at least $48 billion with them.

President Xi’s and the CCP’s economic policies will be tested in his third term – or, as he said in his 20th Party Congress report – “tested by high winds and waves and even shocking waves.”

Whatever the future holds, it seems clear that SOEs will have a stronger role. Recent data shows the value of SOEs, joint-stock enterprises and foreign companies are all growing faster than that of Chinese private companies.

This shows that while economically and technologically powerful foreign enterprises, as well as SOEs with monopolistic positions, will be enjoying any feast in China, domestic private companies will have an increasingly difficult time. Less technologically advanced foreign enterprises will not have an easy time either.