Argentina’s shaky plans to tame high inflation

Politicians have lost credibility because of their inability to tame the rising cost of living. But a new ‘super minister’ will give it another try ahead of the 2023 presidential elections.

In a nutshell

- The Latin American nation is mired in a 10-year cycle of stagflation

- A new economy minister wants to instill fiscal and monetary discipline

- Inflation will likely remain strong, given the populist ways of politicians

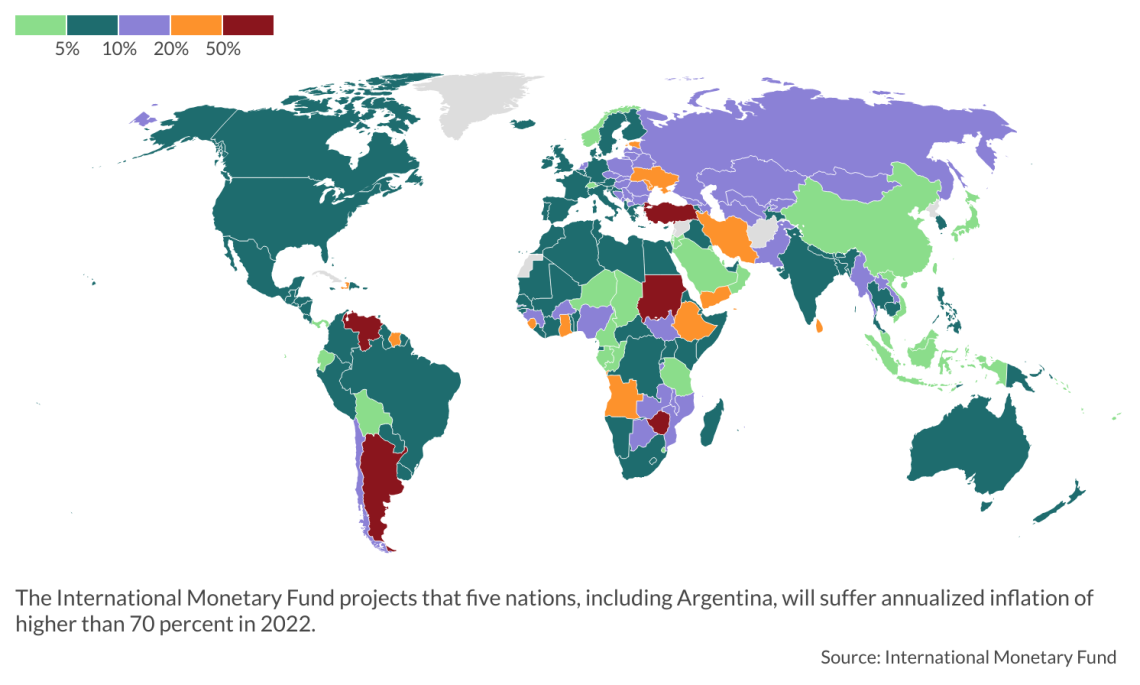

Argentines are facing the highest inflation in three decades and one of the highest around the globe – possibly hitting 100 percent by the end of the year. This economic disaster cannot be traced to a single cause. However, as always, the price increase is fueled by a rapid expansion of the money supply to accommodate government spending. Between April 2019 and April 2022, the monetary base increased rapidly.

Argentina’s economy is mired in a 10-year cycle of stagflation marked by fiscal deficits, slow growth, a high unemployment rate and high inflation. This disappointing record looms larger after the Covid-19 pandemic and the spillovers from Russia’s war against Ukraine, including higher energy and food prices.

Argentine President Alberto Fernandez’s administration has been implementing several fruitless measures: price controls on household goods, large subsidies for public services of transport and energy, monthly adjustments to minimum wages, and, for a while, he even banned beef exports to tame meat prices for local consumers. Nevertheless, wages and savings in the nation of 46 million people are sapped as inflation continues.

On the political front, a rift between President Fernandez and Vice President Cristina Kirchner – Peronism’s most powerful figure – only adds instability. The political division was fully exposed when Ms. Kirchner forced out Mr. Fernandez’s first finance minister, Martin Guzman, last July for trying to implement an agreement with the International Monetary Fund that required a sizeable reduction of the deficit and stricter control of the money supply by the central bank.

Uncertainties following the departure of Mr. Guzman, a disciple of economist Joseph Stiglitz, created chaos for the Peronist government. Another finance minister came and went over internal fighting.

Arrival of the ‘super minister’

The nation now has a new “super minister,” Sergio Massa, who became minister of the economy, production and agriculture on August 3, 2022. Mr. Massa is essentially in charge of the overall economy and is focused on defeating the main enemy: rising prices. His first challenge is to build confidence in the peso by reducing public spending and boosting foreign reserves.

Argentina revolves around the American dollar and how one gets one’s hands on it.

Price fluctuations and exchange rates are everyday matters. Argentina revolves around the American dollar and how one gets one’s hands on it. Citizens have always sought refuge in United States dollar assets as a defense mechanism against instability. Media report the gap between the official dollar and the black market rate daily, like the weather. Although the official currency is the peso, it officially pegs at an unrealistically high exchange rate to the U.S. dollar. However, dollar purchases have been restricted to such an extent that almost no one can get the official exchange rate, creating all kinds of distortions. For example, tourists who trade dollars at official exchanges get more for their home currency thanks to Argentina’s black market, where pesos are traded for 30 percent less than the official rate.

If Sergio Massa pushes inflation down by the next presidential elections without impoverishing more of the population, he will be considered a success.

President Fernandez’s administration has also implemented a strategy to devaluate the peso by sectors, leaving the country with more than a dozen parallel exchange rates, each with different values and taxes. For instance, to rebuild reserves, the “soybean dollar” was introduced by the central bank for soy exports. It only served to incentivize the liquidation of soy stocks. In addition, the government has also established a “tech dollar” for the high-tech industry, and the “Coldplay dollar,” which refers to the rate for paying admission to international shows – such as the recent run of 10 concerts put on by the British band Coldplay. There is also the “Qatar dollar,” named after the host of the World Cup starting on November 20. This special exchange rate will hit Argentine tourists who use credit cards abroad with a higher tax rate on those purchases.

Facts & figures

Scenarios

Complex global backdrop

Domestic policy uncertainty is coupled with a global outlook marked by risk, not only because of the prolonged war in Ukraine. As worldwide inflation hits double digits, the U.S. Federal Reserve has decided to crank up interest rates, giving the dollar its strongest value in two decades.

Monetary policy around the world is also tilting toward rate rises. Higher interest rates mean that debt is more expensive to pay. Such a scenario only adds turbulence to the Argentine economy as capital shifts from developing countries, increasing financial pressure on an already strained government.

The dollarization dilemma

Amid the galloping inflation and peso depreciation is a surging debate on dollarization. The extreme solution of adopting the dollar as legal currency in Argentina remains divisive but is gaining support. Argentina is not alone in exploring a stronger role for the U.S. dollar: Ecuador has adopted the U.S. dollar as the sole legal tender. After seven years of hyperinflation, a dollarization debate is also gaining momentum in Venezuela. In a softer version of dollarization, the dollar would compete with the peso as legal tender, like in Peru and Uruguay.

2023 presidential elections

As the country approaches a general election in 2023, politics and economics will get even more intertwined. “I’ve lost track of all the various dollar exchange rates,” complained Horacio Rodriguez Larreta, the mayor of Buenos Aires and a likely 2023 presidential candidate. Mr. Massa’s failure would get Mr. Larreta closer to the presidential chair.

Persistent high inflation and lower growth will probably exacerbate social discontent and weaken political support for tighter monetary and fiscal policies. The challenge to cut budgets clashes with election-related pressures to ramp up public spending.

On the flip side, taming inflation can win elections. If Mr. Massa pushes inflation down by the next presidential elections without impoverishing more of the population, he will be considered a success. In that case, hopes will be that the governing party is rewarded at the ballot box.

Inflation pressure will remain strong

The right and left have tried to fix Argentine inflation with mostly dismal results. The problem diminishes for a while only to roar back with greater strength. Argentina went through all stages, from the hyperinflation of President Raul Alfonsin (1983-1989) to the disguised inflation of Ms. Kirchner (president from 2007-2015) and Mr. Fernandez’s current gradual but unstoppable inflation.

How will this scenario evolve? The IMF’s latest projections estimate a very gradual easing of inflation during the remainder of this year and into next year, reflecting a combination of tighter macroeconomic policies, reduced policy uncertainties and lower global commodity prices. These projections, though, are highly uncertain.

Strained credibility

However, Mr. Massa’s biggest challenge will be to rebuild credibility. The IMF gave him a boost when on October 7, it approved an immediate disbursement of $3.8 billion. As the current government aims to survive, Mr. Massa’s team is trying to pump as much oxygen as possible before the elections. “Our obsession is the downward staircase of inflation,” he declared in Washington, D.C. He has also announced his plan to reduce public spending to keep the budget below 2.5 percent of gross domestic product in 2022 and 1.9 percent in 2023.

Building credibility in Argentina is not easy, especially given the persistent differences over economic policies within the governing coalition. Inflation expectations have become ingrained in society, and people are skeptical of government and central bank promises. Continued inflation may prompt workers to demand higher wages, potentially triggering wage-price spirals. The risks are high.