Fighting inflation without a road map

Inflation has receded somewhat, but central bankers’ ad hoc decisions could have a lasting impact on economic growth and public finance stability.

In a nutshell

- Inflation has fallen but remains elevated

- Central bankers appear to have no coherent long-term plan

- More tentative policy adjustments are likely

The fight against inflation has produced encouraging results: according to the latest reports, core inflation was 4.1 percent in September in the United States (4.8 percent in June), 4.2 percent in October the eurozone (5.5 percent in June) and 6.1 percent in the United Kingdom (6.9 percent in June).

This is the good news. The bad news is that inflation is still high. The 2 percent target will not be reached this year or the next. According to the latest projections from the Organisation for Economic Co-operation and Development, inflation could fall to about 2 percent only in 2025. Central bankers’ decision to raise interest rates and rein in monetary policy has paid off, but the outcome has fallen short of expectations. Although recession has been episodic and far from severe, the danger of stagnation is palpable.

Some economists have suggested changing the inflation target. For example, Nobel laureate Paul Krugman advocates raising the current target from 2 percent to 3 percent and thus avoiding the so-called “low-inflation trap.” Put simply, it refers to a situation in which current low inflation leads to expectations about low inflation in the future.

Facts & figures

The mainstream view in economics says that if people expect prices to rise very slowly, it can make it harder for governments to control the economy using interest rates. When investors expect prices to remain flat, low nominal interest rates do not translate into expected low real interest rates. So, even if a government lowers interest rates to encourage spending and borrowing, it may not bring the expected outcome.

This line of reasoning is questionable, to say the least. Suffice to say that a decade of money printing has indeed created inflation – during the three-year period 2021-2023 prices rose some 18 percent in the eurozone and 16 percent in the U.S. – and nobody got caught in the trap: markets revised expectations upward rapidly. Investments do not stagnate because monetary conditions are regarded as tight, but because taxation and regulation are heavy, trade barriers are rising and policymaking is erratic.

By contrast, changing the inflation target from 2 percent to 3 percent would further dent the credibility of the central bankers. Central banking is supposed to guarantee price stability, not to engage in manipulating the rules of the game depending on the circumstances. In this light, therefore, the main Western central bankers deserve credit for sticking to their current 2 percent goal and doing their best to persuade public opinion that this is the right course of action.

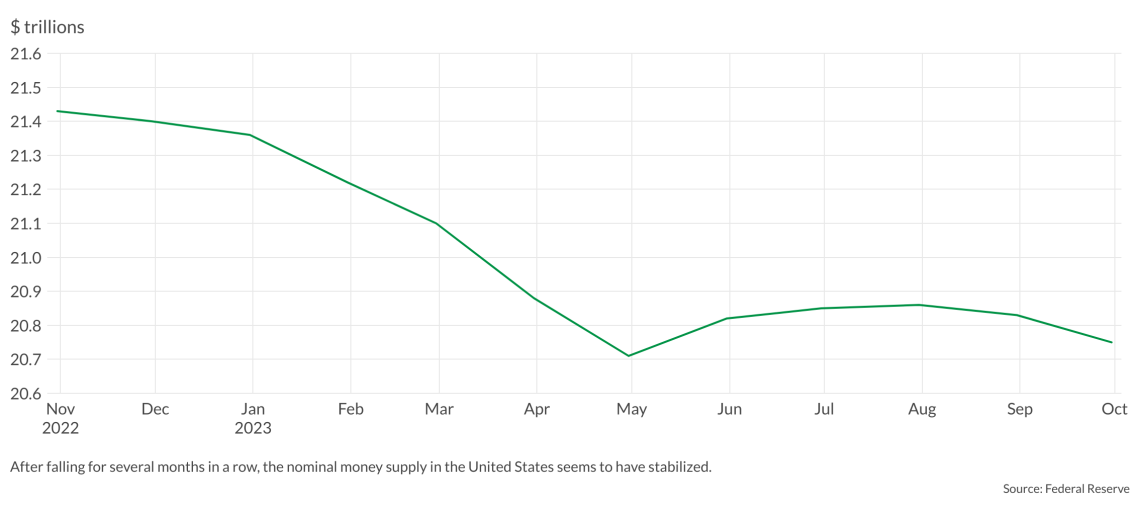

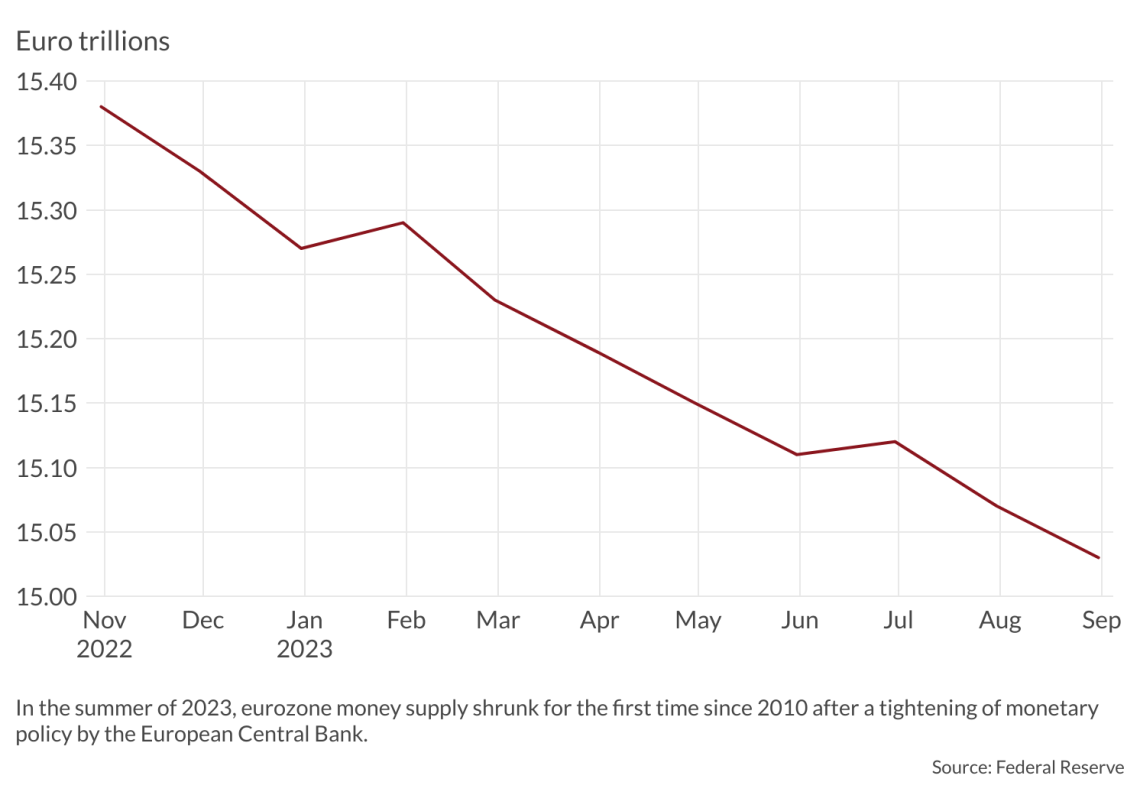

However, the drastic fall in the real money supply experienced in the recent past has failed to get rid of inflation in accordance with predictions, and the rise in the cost of financing might soon bring economic growth close to zero. Monetary authorities are not sure what to do next. They have four options, each of which leads to a different scenario.

Facts & figures

Scenarios

Less likely scenario: Even tighter monetary policy

One option would be to prioritize the fight against inflation and double down on monetary policy to meet the 2 percent target before the end of 2024. This approach would perhaps hit investments. Still, it would find plenty of supporters in the U.S., where some commentators draw attention to U.S. private consumption not seeming to suffer from the rise in the cost of consumer credit or from fears about future inflation.

According to this view, the benefits of tighter monetary policy would overcompensate the costs in terms of real growth. The picture is different in the eurozone, though, where consumer spending is constant in nominal terms and real gross domestic product (GDP) stagnant. Yet, Europe still abounds with pundits who believe that greater government expenditure can compensate for tighter policy, and who ignore disappointing GDP figures as the outcome of taxation, regulation and fears about public-finance crises.

Doubling down on monetary rigor is unlikely on both sides of the Atlantic. A steady rise in interest rates would make sense if central banks announced intermediate inflation targets and were committed to sharpening their monetary tools when those targets are missed. However, no such time schedule has been announced and raising interest rates until inflation reaches 2 percent would make little sense. It would give the impression that the monetary authorities are panicking. This would weaken their fragile credibility and intensify the consequences of monetary stringency, the effects of which have not yet fully emerged, and possibly deliver a fatal blow to the public-finance conditions of several highly indebted EU countries.

Most likely scenario: Erratic policymaking

The most likely scenario could be defined as tentative policymaking. The big three Western central bankers have more or less clearly declared that they do not know where they stand. They have acknowledged that stopping money printing does affect inflation, but also that they are unsure of the speed and intensity of the transmission mechanisms, from interest-rate manipulation to money supply and to price inflation. They have also added that they might further tighten monetary policy, if inflation does not drop fast enough; or ease off, in case of an unexpected drop. It is unclear what “fast enough” means in this context.

The authorities have once again missed an opportunity to spell out what kind of monetary policy they intend to pursue. At present, long-term interest rates on government bonds are expected to stabilize slightly above 4 percent in the U.S. and between 3.5 percent and 4 percent in the eurozone and the UK. Nobody knows whether these predictions are accurate. But everybody knows that the decades of tampering with monetary aggregates have not come to an end and that central bankers will still decide day by day. In particular, even if price inflation is tamed, stagnation or recession may still trigger a new wave of money printing, perhaps under the umbrella of “new” economic theories.

Least likely scenarios: Stable or lower interest rates

The last, far less likely scenarios are that interest rates remain the same, or are cut back aggressively.

If rates remain the same, this would amount to interest-rate targeting. Regardless of the merits and faults of this strategy, central bankers are usually reluctant to follow a fixed rule and insist on exercising discretionary power. In fact, the political authorities expect them to do so, especially when ailing companies need to be bailed out or unappealing government bonds have a hard time finding buyers.

In the aggressive-cuts scenario, one should note that the nominal money supply has generally stabilized in the U.S. and in the euro area. It could be argued that the current interest rates are more or less what it takes to bring about neutral monetary policy (constant money supply), and that today’s price inflation merely reflects the presence of a significant monetary overhang (excess money supply inherited from the past).

In this context, doing nothing would be the best choice, while cutting interest rates would be perceived as a change of tack and a willingness to tolerate inflation. That applies especially to Europe, where core inflation is still high and interest rates are already relatively low (the lending rate net of inflation is still negative despite a steep rise). It would be a loss of face which the European Central Bank and the Federal Reserve Bank can ill afford.

For industry-specific scenarios and bespoke geopolitical intelligence, contact us and we will provide you with more information about our advisory services.