Uncertain strategies for securing supplies of critical raw materials

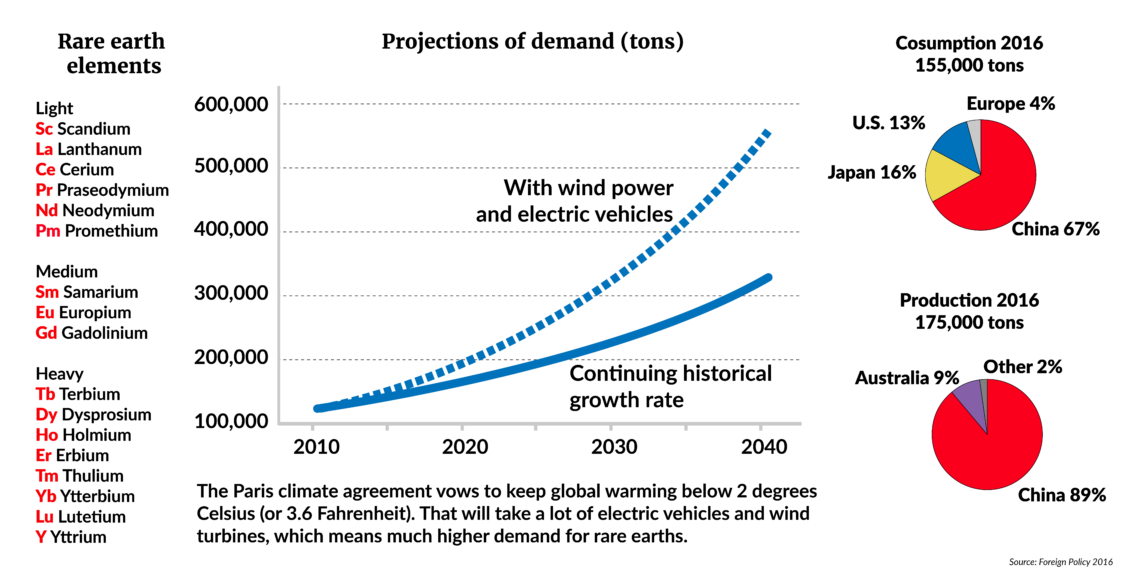

Western industries face a grave challenge: the exploding demand for rare metals and elements could far outpace the projected growth in their supplies. The global market for raw materials is dominated by a handful of countries, and the usual conservation and substitution strategies in the developed world will not kick in soon enough.

In a nutshell

- Rare earth elements and other rare materials are increasingly required in modern industries across all supply chains

- Supplies of many of them are neither sufficient nor secure in the next five to 15 years

- New mining projects, optimization of use and substitution will make a difference, but not soon enough

- The dominance of China and a few other suppliers may have far-reaching geopolitical implications

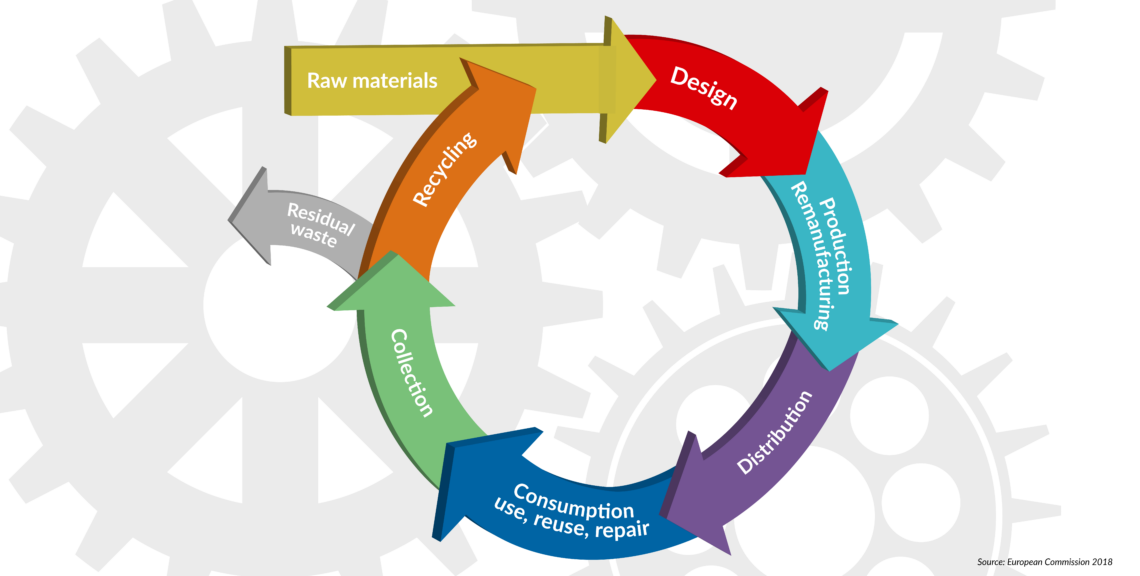

Faced with steadily increasing demand for critical raw materials (CRMs) driven by the rapid expansion of decarbonization and digitalization technologies, governments and industries in the developed world have adopted a range of strategies to ensure adequate supplies of these materials. The cue words are: reuse, reduce, substitute and recycle CRMs, and diversify their imports.

These strategies have their limitations and constraints, however. Substitution and recycling have a long research and development phase, while it takes on average seven to 10 years lead time to open new mines for import diversification. The “circular economy” concept may be a part of the long-term solution, but the present potential to increase recycling and substitution is insufficient to help meet the growing worldwide demand for this class of raw materials.

Indispensable for the future

A sufficient and stable supply of CRMs is essential for the development of more sustainable energy systems. These materials are irreplaceable in “green” and digitalization technologies from “industry 4.0” (the automation and data exchange trend in manufacturing) all the way to artificial intelligence solutions. Typically used in a relatively narrow range of hardware to provide specific functionalities, CRMs are required in industries across all supply chains. They are traded mainly in small, often nontransparent markets characterized by rapid changes in demand and supply, along with highly volatile prices.

Facts & figures

The China factor

China adds a big set of uncertainties to the CRMs supply picture. The country is poised both to join the ranks of new technology leaders and to remain the globe’s largest provider of materials critical to these technologies. It is already the world’s leading CRMs consumer and dominates the value chains of CRMs supply. This situation has wide-ranging geoeconomic and geopolitical implications.

In contrast to fossil fuels, which require continuous delivery to traditional power plants with 30- to 40-year technical lifecycles, CRMs enter wind and solar power stations only when those are built or refurbished (on shorter replacement cycles). Therefore, securing the future supply of CRMs to the power and other industries will hinge on timely investments in mining and modernization (which, in turn, will depend on adequate investment conditions). Implementation of alternative raw materials strategies will play a pivotal role.

These strategies are an integral part of the “circular economy” concept that aims at using CRMs more efficiently and in an environmentally sound fashion.

Facts & figures

A 'circular economy'

New sources

Rare earth elements, or REEs, are 17 metallic elements first isolated out of rare minerals in the 18th and 19th centuries, of little practical use then. On the periodic table, they are in the second row from the bottom. Today, their unique physical and chemical properties make REEs oxides essential for a variety of commercial and military applications. Many of these applications (e.g., windmills) rely, for example, on permanent neodymium magnets that resist demagnetization in high temperatures.

As the demand for REEs surges, countries are seeking to diversify their import sources by investing in new mining projects. In the United States, Tesla, Inc.’s new Gigafactory (which manufactures lithium-ion batteries for electric cars) stands poised to benefit from a recent discovery of rich lithium deposits in the McDermitt Caldera. That geologic formation straddles parts of Oregon and Nevada only a few hours’ drive from the Tesla plant.

Most other makers of advanced technology products are not as lucky.

Facts & figures

The most critical and most at-risk elements

Technology-fix approach

In a different approach to secure domestic REEs supplies, the U.S. Department of Energy is funding research by a team of scientists at the University of Kentucky seeking to develop a cost-effective method of extracting rare earths from coal. The team claims to have found in 2017 a way to obtain a 98 percent pure REE concentrate. The technology is presently being tested. Given that: a) President Donald Trump has promised to revive the nation’s coal industry; b) the modern defense industry is highly dependent on REEs; and c) rare earth mining ceased to exist in the U.S. two years ago, the Kentucky pilot project has been given a high priority by the U.S. government.

The demand growth for REEs can also be mitigated with cheaper substitutes and engineering solutions.

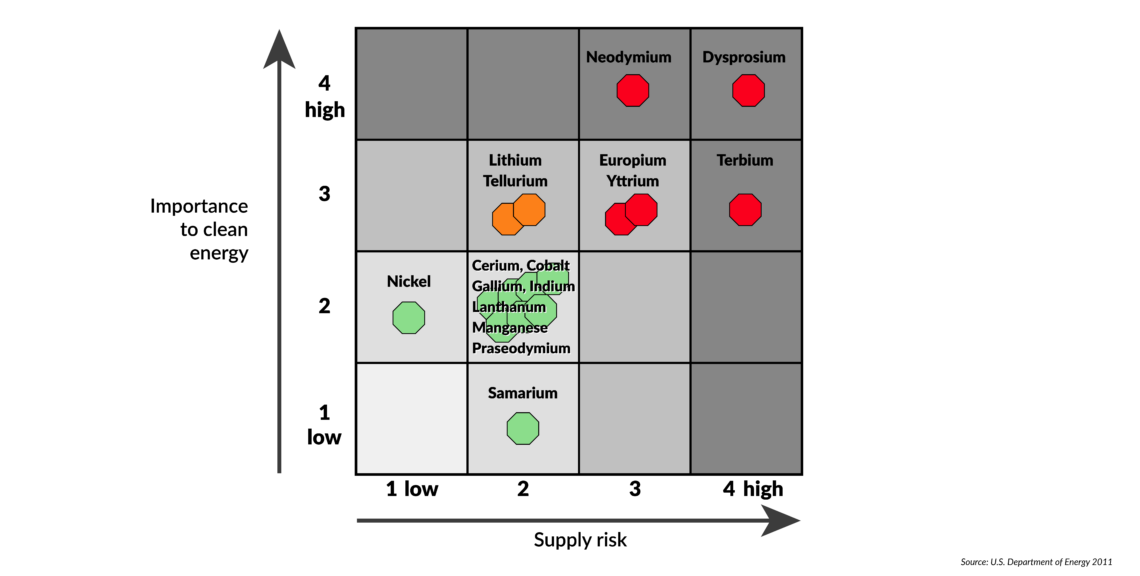

In April 2018, Japan announced the discovery of huge REEs deposits (estimated at 16 million tons of rare earth oxides) on the floor of the Pacific Ocean off Minamitori Island, some 1,850 kilometers southeast of Tokyo and within Japan’s exclusive economic zone. Japanese researchers claim to have developed a technology for extracting REEs from ocean floor mud, but it needs to be tested on an industrial scale. The deposits are big enough, a Japanese researcher wrote in a paper about the discovery, “to supply these metals on a semi-infinite basis to the world” – yttrium for 780 years, europium for 620 years, terbium for 420 years and dysprosium for 730 years.

The impact of such new technologies on supply security and prices will depend on whether, and how soon, they start delivering rare earths on a commercial scale.

Facts & figures

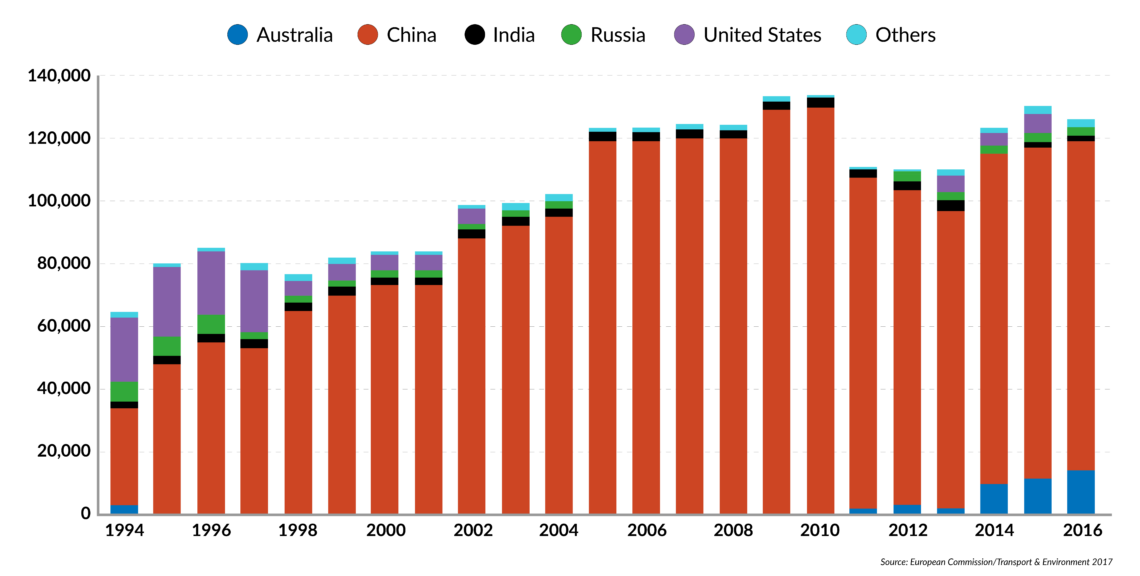

Rare earth element production

(metric tons - rare earth oxide equivalent)

Using less

The demand growth for REEs can also be mitigated with cheaper substitutes and engineering solutions. There has been some progress in this area. The leading electric carmaker Tesla uses no rare earths in the drive train and batteries of its flagship Model S sedan (its AC induction motor does not require magnets). Siemens AG is said to be considering a technology that eliminates dysprosium in wind turbines.

For some REEs, such as neodymium, no material replacement has been found. This element enhances the power of magnets in high temperatures and is crucial for hard disk drives, wind turbines and electric motors typically put in hybrid cars. In principle, such devices can be built without REEs and substitutes are available for many applications. The final products, though, are usually less effective or consume more energy.

In the cases when no short-term substitution of CRMs is possible, the focus is on reducing their use. The General Electric Company reports savings on the number of rare earths used in its lighting products, while Nissan Motor Company’s new manufacturing process reduces the dysprosium in its electric cars engines by as much as 40 percent.

The U.S. lighting industry has decreased its REEs demand since 2014 because new light emitting diode (LED) bulbs contain less of these substances than compact fluorescent bulbs. In early 2018, Toyota Motor Corp. announced the development of a heat-resistant magnet for electric vehicles that requires 50 percent less neodymium and no terbium and dysprosium to make. In that technology, neodymium is replaced by two less expensive REEs, lanthanum and cerium. The new magnets for engines and other applications are expected to enter the market in the first half of the next decade.

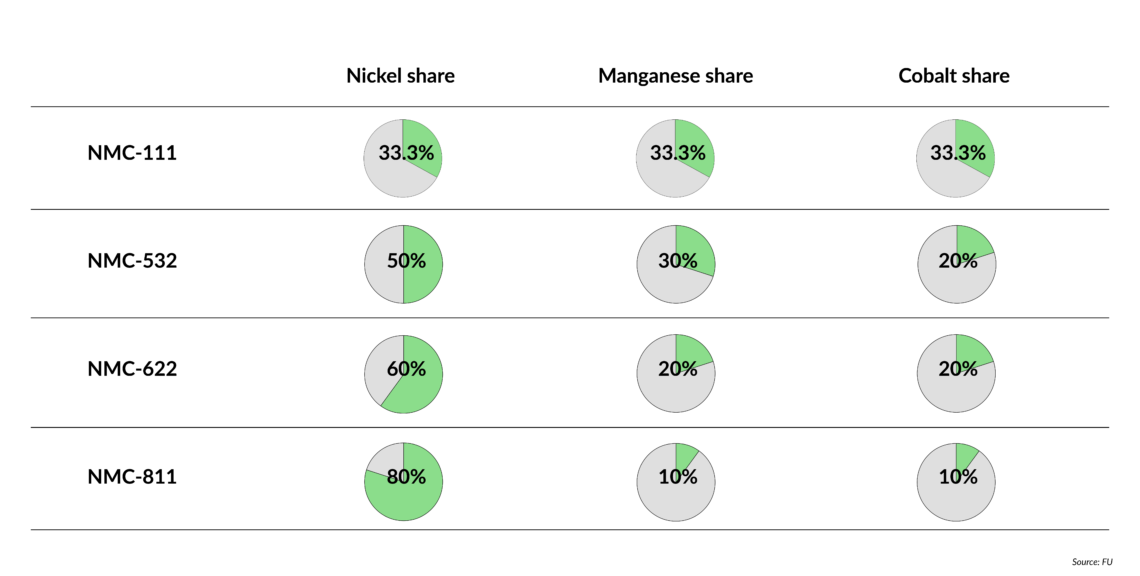

In the development of critical electric battery technology, the strategy is to minimize the use of cobalt, the most expensive raw material. Cobalt is rarely found as a native metal in the earth’s crust. It comes mostly as a by-product of other metals extraction: 61 percent from copper mines and 37 percent from nickel mines. Only 2 percent of the metal arrives in the market from primary cobalt mines.

Tesla has achieved a significant reduction of cobalt content per battery pack while increasing nickel content and maintaining superior thermal stability.

Facts & figures

NMC shares in lithium batteries

The NMC 811 will reduce Tesla’s future need for cobalt, but most other EV makers are expected to rely on older designs with a higher content of the metal. Low cobalt batteries are expected to reach only a 25 percent market share by 2026, meaning the technology will only marginally impact the global rise of the cobalt demand in the medium term.

Recycling’s slow start

The conservation trend involves “urban mining,” such as recycling valuable materials from used electronic devices. Thus far, the end-of-life recycling of manufactured products is taking place mostly to recover cobalt – the priciest CRM. It becomes economically viable only if other CRMs, lithium and graphite can be recovered. Cobalt recycled in this way is cheaper than that extracted from ores.

Due to strict environmental regulations, lead-and-nickel-based batteries have a life-end-recycling rate of 99 percent in Europe and North America. In the future, new electric vehicles will be allowed for sale in the EU only if their NMC batteries can be recovered, reused and recycled in line with the community’s end-of-life vehicles directive. As a result, some companies are already investing in Europe in used EV battery businesses.

On the other hand, smartphones and other electronic devices contain up to 70 different CRMs, but it is still not profitable to recycle them. Worldwide, only a few CRMs (vanadium, tungsten, cobalt and antimony) have high recycling rates. Of the nine CRMs added in 2017 to the EU’s list of critical raw materials, all have low or even nonexistent recycling rates. The overall trend of miniaturization in electronics compounds the problem by making disassembly of components more challenging. Larger-scale recycling is not expected to take off before 2025.

Long road to supply security

Many Western manufacturers are presently burning through their CRM stores faster than they can be replenished with new shipments. Access to these materials will affect these companies’ future prospects. For example, the Volkswagen Group plans to invest 70 billion euros in electrifying 300 different car models by 2030. Presently, however, the company cannot secure the cobalt supply needed to make these plans a reality. New production of the metal outside the Democratic Republic of Congo (DRC) appears years away, complicated by international demands for more transparency and responsible mining of “ethically sourced” cobalt. Some analysts predict a 30-fold increase in the global demand for cobalt by 2030.

REEs will remain difficult to mine as these elements are rarely found in concentrations high enough to allow economic extraction. Typically, rare earths are enmeshed with other metals and laced with radioactive thorium, which is hard to separate and dispose of safely. REEs deposits are expensive to mine in Western countries also because environmental regulations are much stricter than in China. For example, the only U.S. REEs mine, in Mountain Pass, California, closed repeatedly between 2002 and 2015 for economic and environmental reasons. In the summer of 2017, a Chinese-led consortium bought the mine out of bankruptcy.

China is in a position to underprice competitors regardless of how many new REEs mines open up in the U.S.

In 2017, China still accounted for about 85 percent of rare earth elements supply and still seeks to expand its strategic control of REEs in other countries (including Greenland). According to the U.S. Geological Survey, the worldwide reserves of rare earths amount to approximately 120 million metric tons. As much as 44 million metric tons are in China.

By 2015, about a half of the global demand for rare earth oxides was coming from makers of permanent magnets for EV motors. As the U.S. defense industry relies entirely on China for its REEs supplies, President Trump has issued an executive order aimed at helping to restore the domestic production of the commodity. However, as the REEs market is now controlled by China (including the refining processes), the Asian giant is in a position to underprice competitors regardless of how many new REEs mines open up in the U.S. and elsewhere.

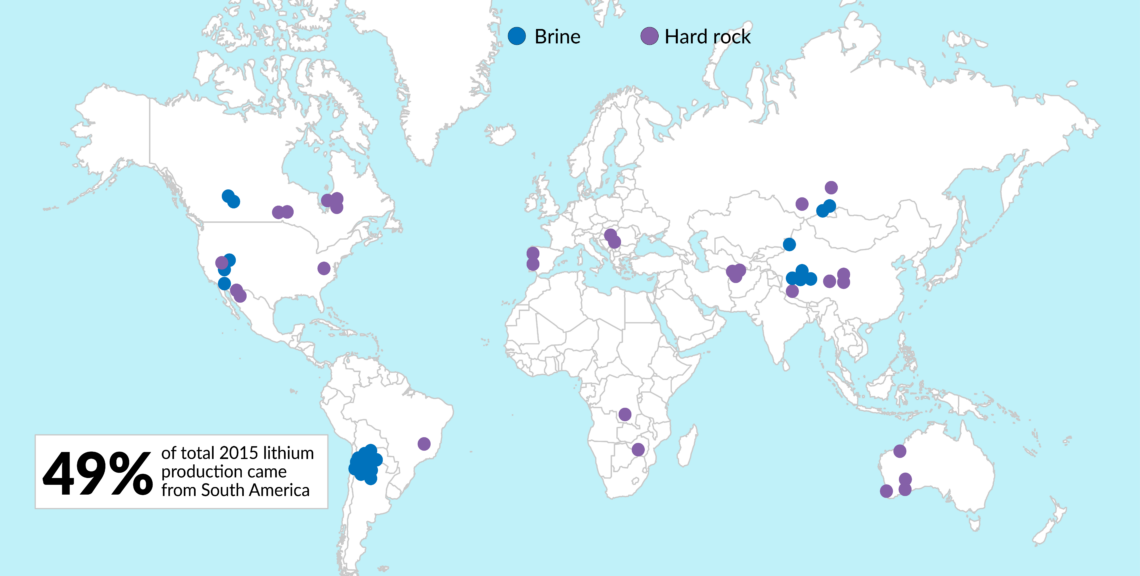

Lithium

Global reserves of lithium are estimated at up to 47 million tons. The alkali metal is mined on six continents, but largely in the “lithium triangle” of Chile, Argentina and Bolivia. Together, these countries account for 49 percent of the global production and are called “the new Middle East” of the EV era. Their lithium is extracted from continental brines and cheaper to obtain than from Australia’s hard-rock ore.

Facts & figures

Major lithium deposits by type

Australia is today the world’s leading lithium exporter and may remain so, even though Bolivia’s lithium deposits are larger, with an estimated 50 to 70 percent of known world reserves. Bolivia’s drawback is its system of state controls, which adds to the cost of production and refining, and the fact that as a landlocked country, which increases transport costs to world markets. In Chile, exploitation of lithium-rich brines is a threat to the country’s water supply.

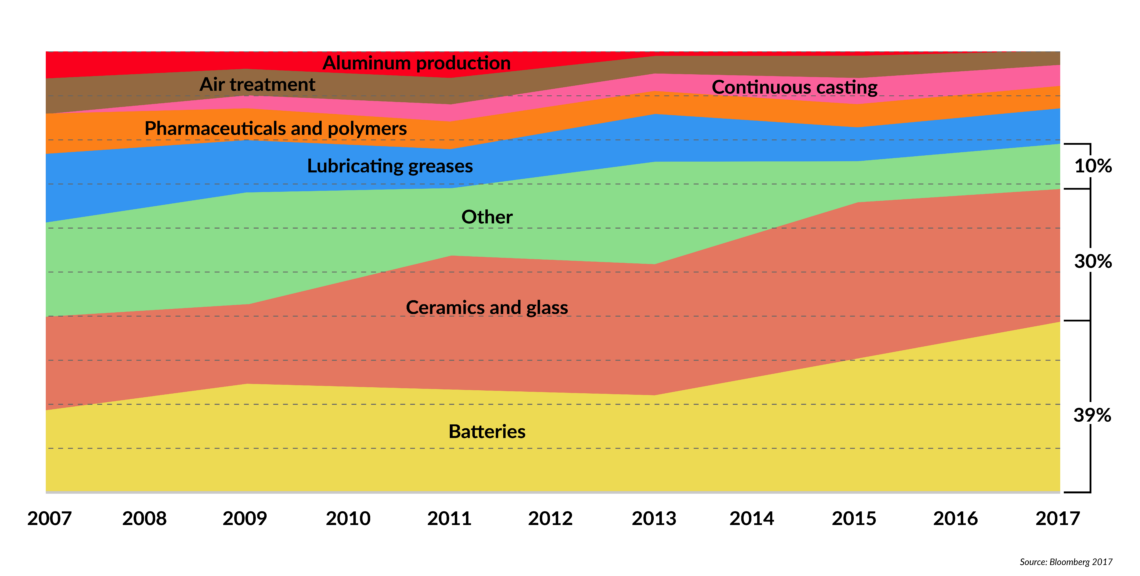

Facts & figures

Global end use of lithium (proportion of total), 2007-2017

Even if international efforts to curb growing demand for REEs prove effective and the global supply picture improves, the overall demand for rare earths is forecast to keep rising sharply in the foreseeable future.