The disillusionment and hope of Western sanctions against Russia

Western sanctions against Russia have fallen short due to inconsistent implementation and Moscow’s ability to find alternative supply lines.

In a nutshell

- The failure of sanctions to thwart Russia’s invasion was predictable

- Economic self-interest has trumped the moral case for Ukraine

- Russian influence operations over sanctions will likely grow more effective

The track record of economic sanctions against Russia has proven what everybody in the West knew, or should have known, from the outset: this is a dubious weapon. The threat of sanctions had provided zero deterrence against Moscow’s ambition to launch a full-scale invasion of Ukraine. Since the war, the subsequent implementation of sanctions has been so erratic that the effect on Russia’s war effort has been marginal at best, with critically needed technologies still flowing to Russian arms makers via third countries.

Predictable failure

The very idea of using economic sanctions to counter military aggression was never entirely sound. The counterargument has been that for governments with no stomach for a military response – but who still feel that they must go beyond harshly worded condemnations – economic sanctions are the only recourse.

The political logic of this argument is strong, but relying on the presumed effects of economic sanctions was a mistake. While the moral commitment to the defense of Ukraine made it imperative for Western governments to do something, they were reluctant to face the short-term costs of taking proportionate action. It was bound to be too little, too late.

A case in point: over the first year of full-scale war, according to the Financial Times, the European Union paid Russia more money for oil and gas than it provided for Ukraine’s war effort over the first two years. Fearing the consequences for its energy security, Germany put up a hard fight to exclude Russian gas (and Russia’s Gazprombank) from sanctions so that payments for gas could still be made.

This was a predictable development, and Moscow surely must have expected it – undermining from the start the impact of the West’s threatening rhetoric. Moreover, Russia had already experienced eight years of watered-down sanctions in response to its 2014 invasion of Crimea. There was little reason for the Kremlin to believe that this time would be so different.

Read more on Russia’s invasion of Ukraine

- How F-16s could change the war in Ukraine

- The burgeoning China-Russia axis

- The quest for military superiority in Ukraine

Germany has been far from alone in skirting the total imposition of sanctions. When the European Union tried to curb Russian revenues from oil exports, Greek shipping magnates stepped in to offer their tankers as a way of avoiding the restrictions. Their efforts included loading oil from Russian to Greek tankers at sea and selling old tankers to Russia – developments that could have hardly escaped the Greek government’s awareness.

Even Poland, which is otherwise staunchly pro-Ukraine, has been a source of Russian imports. In December 2023, Polish exports to Belarus apparently reached record highs – including items clearly not destined to end up only in Belarus itself. An apparent discrepancy has angered some Ukrainians: while Polish farmers are blockading Ukrainian trucks seeking to cross into their country with vital cargoes, Polish trucks have been doing a brisk trade across the Belarusian border.

Given that different governments within the EU had varying levels of exposure to the Russian market (not to mention divergent attitudes on whether sanctions should be imposed in the first place), it was a given that reaching an agreement on sanctions packages with a real bite would be complicated. Over time, loopholes have been closed, and governments have been pressured into compliance, but in the meantime, Ukraine has been bleeding badly.

Influence operations

It was no surprise that clandestine Russian operations would be active from the outset of the war, seeking to dilute sanctions and inform Moscow on how to evade them. While some countries have been more susceptible to such activities than others, few, if any, have been entirely immune. Influence operations have ranged from propaganda campaigns to outright espionage.

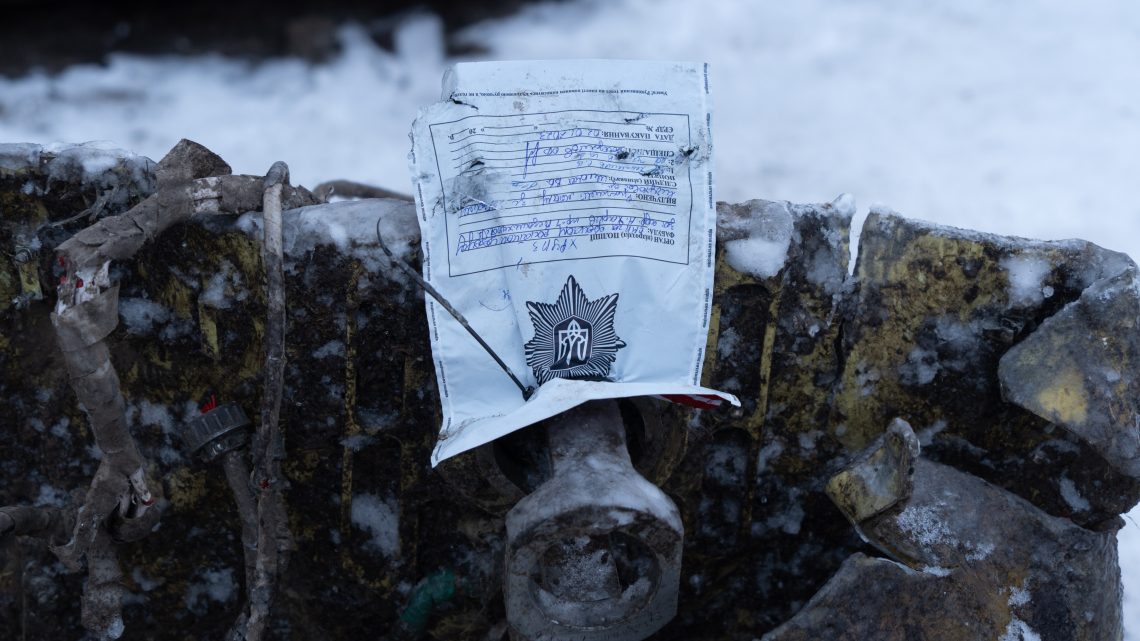

The EU was a bit embarrassed by an Insider report this year on an operative of Russia’s GRU military intelligence, based in Brussels, who was providing Russian arms manufacturers with European-made hardware to measure coordinates, which are used to make hypersonic missiles.

Ingenuity in finding new ways to dodge sanctions has outpaced the bureaucratic efforts to coordinate stakeholders, close loopholes and shut down transit routes.

The core of the problem is that expecting private sector actors to shoulder the burden of cutting all links to Russia, on moral grounds alone, was ill-advised. Without stringent controls to ensure compliance by all, material self-interest was bound to lead to some breaking of ranks. And once erosion began, the dam broke.

Despite valiant ambitions from Ukraine and its allies to shame companies remaining active in Russia, many have weighed their profits in the Russian market against the costs of global brand damage – and concluded that staying is preferable, even if it means paying tax revenues into the Kremlin’s war chest. When the American journalist Tucker Carlson rounded off his interview with President Vladimir Putin by going shopping in Moscow – and touting what a positive experience it was – he was visiting an outlet of the French supermarket chain Auchan.

Circumventing sanctions

In a further blow to the sanctions regime against Russian oil revenues, American companies that play significant roles in Russian oil extraction have also dodged compliance. While Halliburton did finally sell its Russian operation in September 2023, customs data obtained by The Guardian showed that even after the move, company subsidiaries still made some money in shipments to its former Russian unit.

Rival firm Schlumberger, meanwhile, changed its name to SLB and actually grew its Russian business, picking up opportunities as others left. It announced it was pausing operations only in July 2023; later that year, a spokesperson said that “nothing has changed” since the firm admitted it had no plans to leave Russia. This stands in contrast to oil giants such as Shell and BP, which, soon after Russia’s invasion, announced they were leaving the country and writing off their investments.

With respect to the heavy flow of critically needed electronics that Western manufacturers are providing for the Russian arms industry, it is hard to believe that national governments are unaware of what companies at home are doing. Analysts have pointed to rising exports to Russia via countries in Central Asia and the South Caucasus since the invasion of Ukraine. In one telling example, Robin Brooks, chief economist at the Institute of International Finance, noted on X in December 2023 that “roughly half of Germany’s exports to Kyrgyzstan … never show up in Bishkek according to Kyrgyz data on imports from Germany.” He argued, “Kyrgyzstan is just what gets written on the invoice. Stuff never goes there. It goes to Russia. German exports to ‘Kyrgyzstan’ must stop.”

These exports invariably end up in Russian missiles raining down on Ukraine. Officials in Kyiv have sought to shame visiting Western politicians by showing them debris from downed Russian missiles containing recently manufactured electronic components from their respective home countries. The impact of such shaming has not been overwhelming.

What’s more, Russia is not the only country receiving Western electronics for its arms industry. According to a CNN report, a North Korean missile that hit Kharkiv in January was made mainly of Western components: Out of 290 examined parts, 75 percent came from American companies, 16 percent from European ones and 9 percent from Asia.

The logic of self-interest

With an important caveat (to be described in this report’s scenarios section), the sanctions regime will likely remain ineffective. While each successive sanctions package casts the net wider and closes loopholes, the measures have not curbed the Russian war effort nor caused the Kremlin to contemplate leaving Ukraine.

This was eminently predictable. One reason is that when vital national interests are at play, authoritarian regimes will not only be ready to absorb severe punishment – they may even succeed in making their own suffering populations rally around the flag. The record of sanctions against countries like Cuba, North Korea and Iran should have made that clear from the beginning.

The second, and more worrying, reason concerns the size of the Russian market and the lure of doing business there in a post-war environment. What has really turned anti-Russia sanctions into a losing game for the West is material self-interest. Predictably, ingenuity in finding new ways to dodge sanctions has outpaced the bureaucratic efforts to coordinate multiple stakeholders, close loopholes and shut down transit routes.

As a result, the Russian arms industry has recovered its inflow of electronics supplies to something close to pre-war volumes, and Western luxury goods have returned to shopping malls in Moscow and other large cities. The Russian regime has consequently been strengthened in its belief that the war can still be won – because the West will inevitably fracture and fragment.

Scenarios

More likely: Commercial interests trump sanctions

The baseline scenario is that as the war drags on and sluggish deliveries of Western military aid weaken Ukraine’s position on the ground, Russian influence operations will become more effective, targeting both pro-Russian and sanctions-weary segments of Western media and political circles.

Although the moral argument in favor of supporting Ukraine will remain strong, it will be increasingly sidelined by the material self-interest in bringing the conflict to a negotiated end – on terms advantageous to Russia.

Less likely: Sanctions disrupt Russia’s war machine

An alternative, less likely scenario under which sanctions do make a difference stems from the fact that the U.S. has finally begun deploying the only economic weapon with a severe bite: secondary sanctions against the money flows. For countries and companies that have been making handsome profits by evading sanctions, trade with the U.S. and with American financial institutions is vastly more important than trade with Russia, directly or indirectly. As this reality is now being incorporated into serious policy, the sanctions game may undergo meaningful change.

The recent decision by three of the four largest Chinese banks to stop accepting payments from Russian entities under sanctions could have significant consequences. The threat to Moscow is enhanced by news that banks in Turkey and the United Arab Emirates have also begun to limit payments and close accounts of companies and individuals from Russia. The Greek shipping magnates that were doing good business on Russian oil exports have begun to see the writing on the wall. In a notable shift, Uzbekistan recently decided to impose sanctions on Russia.

While these steps are still unlikely to cause enough pain to Russia that it decides to pull out of Ukraine, they could diminish the Kremlin’s ability to finance its war effort and acquire critical components for its war industry – even enough to turn the tide in Ukraine’s favor. If targeted sanctions against Russian financial flows are joined by a decision to finally transfer frozen Russian assets to Kyiv, Ukraine may gain the upper hand.

For industry-specific scenarios and bespoke geopolitical intelligence, contact us and we will provide you with more information about our advisory services.