Liechtenstein’s use of blockchain may upend the finance industry

One of Europe’s smallest states is writing a whole new book on harnessing the potential of blockchain technology to modernize the finance industry. The innovative approach could give the Principality of Liechtenstein pole position in the blockchain race.

In a nutshell

- Liechtenstein uses blockchain to reshape the finance industry

- Its legislation unlocks the technology’s innovative potential

- Trust and control problems in the system can be solved

The development of distributed ledger technologies – known as DLT, or blockchain – is progressing in big strides. One of the most notable projects in the field is Liechtenstein’s drive to revolutionize the finance industry. DLT could enable a new system that eliminates intermediaries, is fraud-proof and may, in the longer term, replace institutions such as banks, company registers, automobile registers, and most other fixtures of today’s financial world. The benefits include vastly reduced costs and a huge boost in efficiency.

To bring this vision to life, the principality has created a unique institutional ecosystem in which technology developers, regulators and lawmakers work hand in hand.

Pioneering initiative

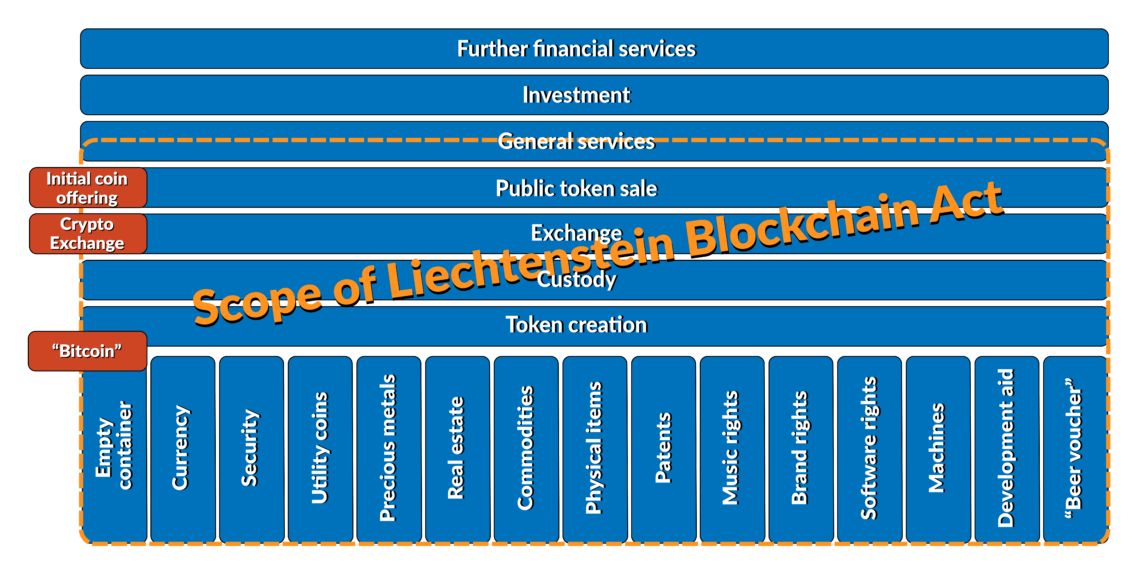

Liechtenstein recognized blockchain technology’s immense potential early on. Conceptual work on legal and institutional foundations for DLT began in the principality in 2016; three years later, groundbreaking framework legislation on a Tokens and Trustworthy Technology Service Providers Law (TTTL, or in German TVTG), known simply as the Liechtenstein Blockchain Act, was passed.

Before the law came into force on January 1, 2020, its supporters argued that TTTL would enable hundreds to thousands of crypto tokens. New economic uses would be identified, creating significant added value for society. This is precisely what is happening: private sector investors and administration officials are working side by side, developing a new ecosystem for creating and implementing the technology.

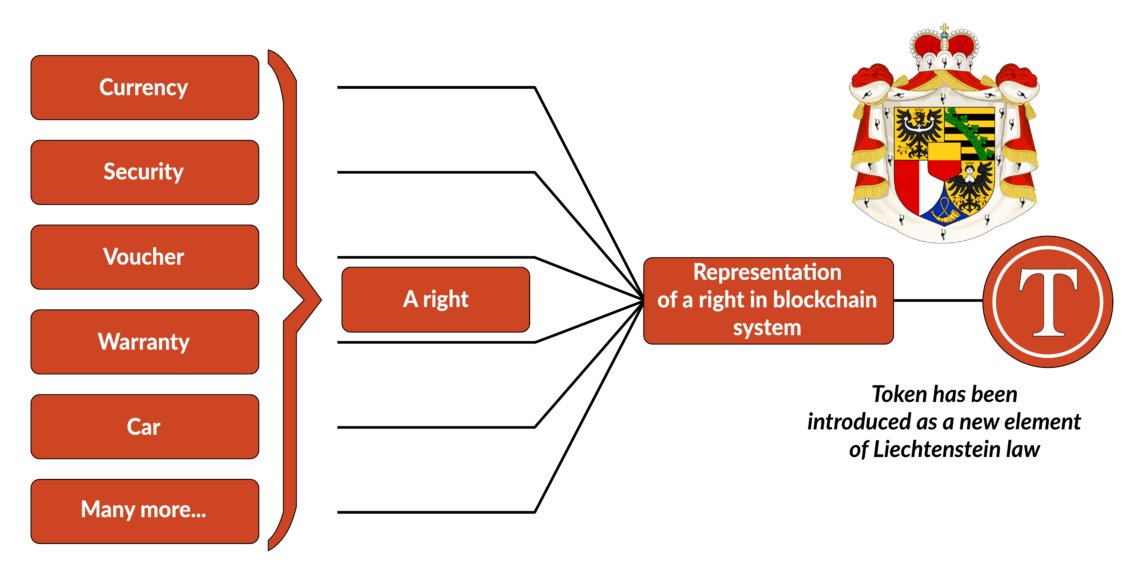

As a result, Liechtenstein has put itself on the map as a pioneer in the international blockchain arena. The TTTL recognizes the token as an ideal instrument to hold assets on a blockchain. It allows almost all rights and, ultimately, any asset to be “tokenized.”

Facts & figures

In this context, tokenization boils down to digitally represented ownership of certain physical goods or intangible assets such as rights – i.e., to digitally certify them in a forgery-proof form. The assets can range from government bonds to shares, real estate and ownership titles all the way to physical articles such as pieces of art or gold bars. The technology sets no practical limits in this respect, however, it needs to be backed by corresponding legislation.

How it works

The TTTL neither commits investors to a particular type of blockchain technology (the law uses the term “trustworthy technology”) nor excludes any asset from tokenization. The crucial element is its Token Container Model – a secured digital storage box for everything to be tokenized. The owner’s rights remain unchanged as the asset becomes a technically packaged security accompanied by a set of rules, licenses and obligations linked to it. So far, the Token Container Model is the best approach to understand the interplay between tokens on DLT systems and existing rights.

Put differently, as of January 2020, nearly any right or asset can be “packaged” into a token according to the container model.

Facts & figures

In the gold bar example, when the rights to the bar are tokenized, the shares are “loaded” into a container that represents the token. Whoever owns the token now owns the corresponding share of the gold bar. The rights are unforgeable, and the bar does not need to be physically moved. It remains in a secure place (e.g., a safe). The ownership issue is handled in any location, entirely via a blockchain and the principle of tokenization. This applies to smaller private users as well as institutional customers of all kinds. All compliance requirements need to be met.

Liechtenstein thereby acknowledges that – driven by digital transformation – the physical world as we know it will soon be augmented by a digital world. The situation in which influence and power are primarily determined by an objective digital distribution – and are not linked to physical superiority or resources – has very far-reaching consequences, including political ones.

The Token Container Model also creates the need for new players within the economy. Infrastructure needs to be provided before the customer can use a token at the push of a button.

Institutional needs

Different phases of tokenization and token usage require specialized actors such as a party that generates the tokens (“token generator”); a party that issues the tokens in a controlled manner and manages the issuance itself (“token issuer”), and a party that holds the tokens in safekeeping (“token depositary”). In most countries, the principle use of tokenization is based on blockchain technology but can be associated with workarounds in some cases.

Liechtenstein ensures that the real world and its digital representation are synchronized.

Liechtenstein’s TTTL makes all this possible without complications. This new branch of the economy has a strong pull. Its diversity creates attractive new jobs and opens up institutional conditions for an economically-sound crypto space in Liechtenstein and beyond.

There is much to be said for the idea of expanding the digitalization of our environment, including our rights and assets, in an unforgeable framework. Liechtenstein also ensures that these two worlds, the real one and its digital representation, are well synchronized so that each reference to the real world can also be set as an anchor point in the event of irregularities with the TTTL (e.g., lost or stolen tokens). The fact that a modification of the civil law was also introduced to enable this synchronicity is particularly noteworthy. The TTTL is thus a mix of the new rules and modifications of the preexisting laws.

Furthermore, what makes the TTTL stand out in international comparisons is that it considers all kinds of tokens, not only securities – everything in one law and method. As a result, a steadily expanding ecosystem has emerged: its potential can be exploited within an institutional framework. Most countries in the world are still missing this point, while Liechtenstein is already busy exploring blockchain technology’s economic and social applications.

Given the need for top-notch security protection for both customers and financial institutions in our established social structures, all applications related to alternative financial services are subject to elevated governance standards. The tokenization of other assets can also be associated with uncertainties and risks, hence the need for a guarantor who can correctly access the situation regarding risks and obligations in boundary cases. For this reason, the legal system and private sector application contexts need a close, symbiotic relationship in nurturing new DLT technologies. After all, creating a parallel financial universe based on DLT without corresponding institutional structures would make little sense. The TTTL establishes a framework to reconcile the world of existing rights and regulations with the future DLT-based infrastructure.

Liechtenstein aims to have a new kind of symbiosis of these two worlds. Innovation knows no difference between the public and private sectors. To achieve international success with new technologies, the two parts must work together. The state needs to respect the private sector’s right to pursue disruptive innovation. The private sector, for its part, does well accepting a reasonable degree of state regulation of the innovation to minimize the risk of inadvertently causing damage to the public or reducing the common welfare.

Some countries are not embracing fully their digital future.

The large and agile Liechtenstein blockchain community attests to the benefits of this practical approach. The principality recognized the need for such a symbiosis early on and took action, while other countries continue to stunt progress with arbitrary and lengthy bureaucratic processes. In the end, more governments will probably adopt Liechtenstein’s symbiotic system of technology institutionalization, giving a further boost to blockchain.

Although some issues remain that need to be resolved (most of them related to scalability and institutional security of DLT applications), the biggest obstacle faced by the technology today is the self-preservation reflex of legacy state bureaucracies. As a result of that opposition, some countries are not embracing fully their digital future.

Problems and obstacles

There remain, of course, roadblocks to be cleared and challenges to be tackled. Blockchain critics list the high level of anonymity and the lack of provisions against crimes like money laundering and tax avoidance as obstacles to using blockchain in financial applications. These are, to an extent, valid concerns. The very logic and design of this technology usually put it beyond any central or state control. However, companies that offer blockchain-based or blockchain-assisted services are not limited to them in their relationship with customers.

It will be all about nurturing the most promising innovations in one’s country to improve its competitiveness.

For example, typical crypto exchanges use elaborate customer identification systems before lifting certain trading limits to prevent tax evasion. Also, they now often prepare legally required annual reports for their customers that must be submitted to the tax authorities along with regular tax filings.

The extent to which the authorities must provide automated access to this data remains to be decided in future regulations. The matter remains a subject of hot debate even with respect to standard stock trading. And the fact that a certain percentage of transactions escape government control is not a problem limited to blockchain technology. Tax evasion takes place within the current systems as well.

Scenarios

The technology still needs work, but Liechtenstein’s innovative legalization and approach to applications could give it pole position in this area of financial services. Providers of blockchain applications are working on the challenges, searching for the best ways to put security mechanisms in place between the customer, the economic entity and the blockchain.

In 2021, the technology will continue to be a topic of much public discussion and education, which helps the spread of blockchain technology. The attention given recently to Bitcoin and other surging cryptocurrencies that represent only one of many applications of DLT will serve as a useful driver for building general knowledge of the technology that underpins the manipulation-proof and traceable “software money” applications. (Liechtenstein is home to some crypto exchanges, already regulated under the law, but it does not offer its own currency of this kind.)

So, what happens when the relevant stakeholders are fully enlightened and no longer feed on dangerous half-knowledge? A powerful technology unfolds.

We may witness a kind of “quest for the best” competition on the international DLT playing field on the institutional side. It will be all about nurturing the most promising innovations in one’s country to improve its competitiveness. Having a vibrant start-up landscape dealing with blockchain technology could go a long way toward strengthening a country’s economy and its international standing. Liechtenstein is already consuming the first fruits of this strategy.

Goodwill will not suffice in this talent contest; offering the necessary legal, organizational and financial frameworks will be crucial. Start-ups and good ideas that do not feel comfortable in one country will move on and develop their innovative power elsewhere.

On the economic side, one can expect to see competition heating up, caused by a fast-growing number of business applications. Changes in blockchain’s perception will play a role too. The economically fittest uses for DLT technology will prevail and win a chance to dominate the international market in the long term.