The bankruptcy of Xiconomics

The Chinese leader’s stubborn adherence to flawed policies has global implications as growth is likely to remain slow for decades in the world’s second-largest economy.

In a nutshell

- The Chinese leader’s ideology deters foreign investment and favors the state sector

- A real estate bubble and excessive local government debt threaten growth

- Cutting-edge industries and innovations are helping to stabilize the economy

Since Chinese President Xi Jinping forced his way into a third term of office, he has tried to build up a great image of himself as an all-knowing leader. He wants Chinese people to learn from his “theories,” especially economic ones. Recently, during the BRICS summit in South Africa, Xinhua News Agency held a briefing on President Xi’s economic thinking for the participants there. It was mainly targeted at African politicians. Given the state of China’s economy, promoting the Chinese leader’s theories was ironic.

Xiconomics – a hodgepodge of contradictions

Many in the West had high expectations for Mr. Xi when he came to power in 2012. This led to the characterization of his economic rhetoric as Xiconomics. Over time, however, it became clear that his philosophy was a hodgepodge of contradictions.

His dual-circulation theory sees China as simultaneously open to the world but also focused on strengthening domestic supply chains and self-sufficiency. At first glance, there seems to be nothing wrong with the strategy since it focuses on the domestic market and increasing internal consumption. His advocacy of “creating common prosperity” also seems to be the right thing to do, with a socialist flavor.

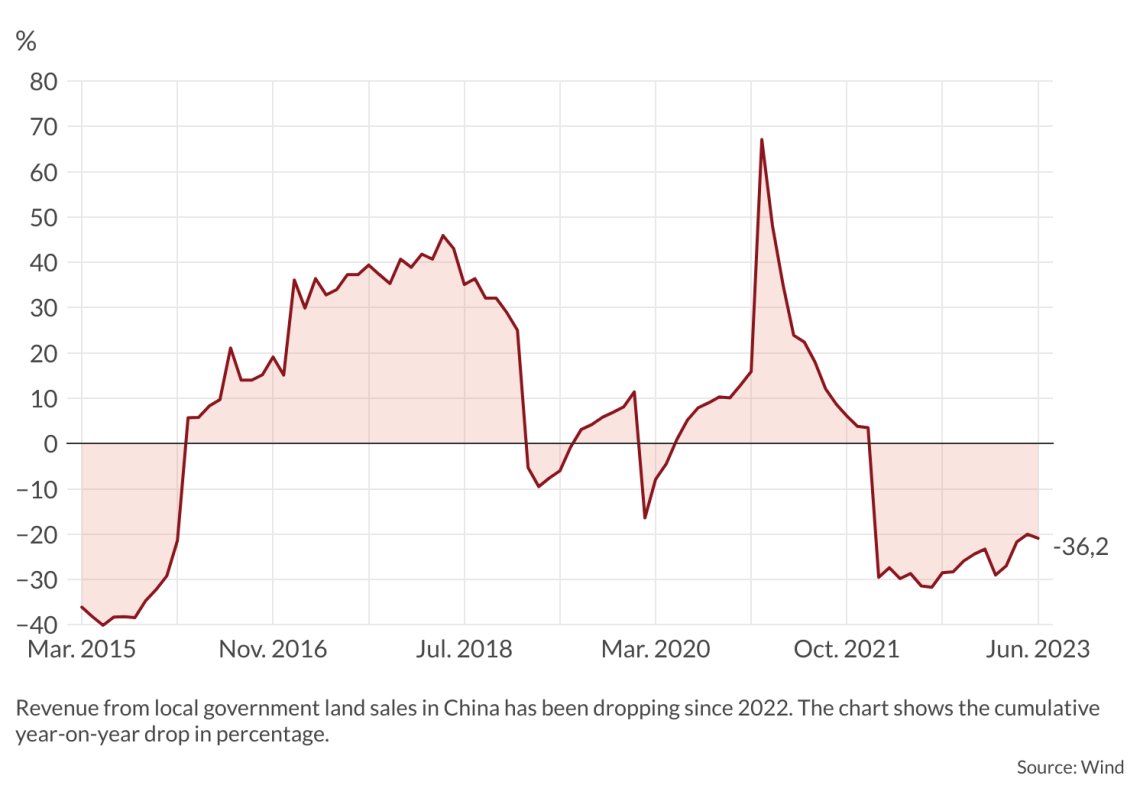

But if one looks closely at the specific instructions he has given to the domestic sectors of the economy, the cracks are immediately revealed. Take real estate, for example. President Xi has a very clear instruction on this, namely that “houses are not for speculation,” meaning the government should prohibit any speculation in this sector. The reality is that for a country where 70 percent of households already own their own property and where the average residential space per capita has reached 40 square meters, the supply of real estate in China far exceeds the demand. And more crucially, the real estate disaster comes from irresponsible land sales by local governments. This is a systemic design flaw inherited partly from the Chinese leader’s predecessors. As a result, China has many more properties than its population needs.

More by Junhua Zhang

Prospects for the yuan unseating the dollar

China’s export controls are set to backfire

China’s new high-risk strategy

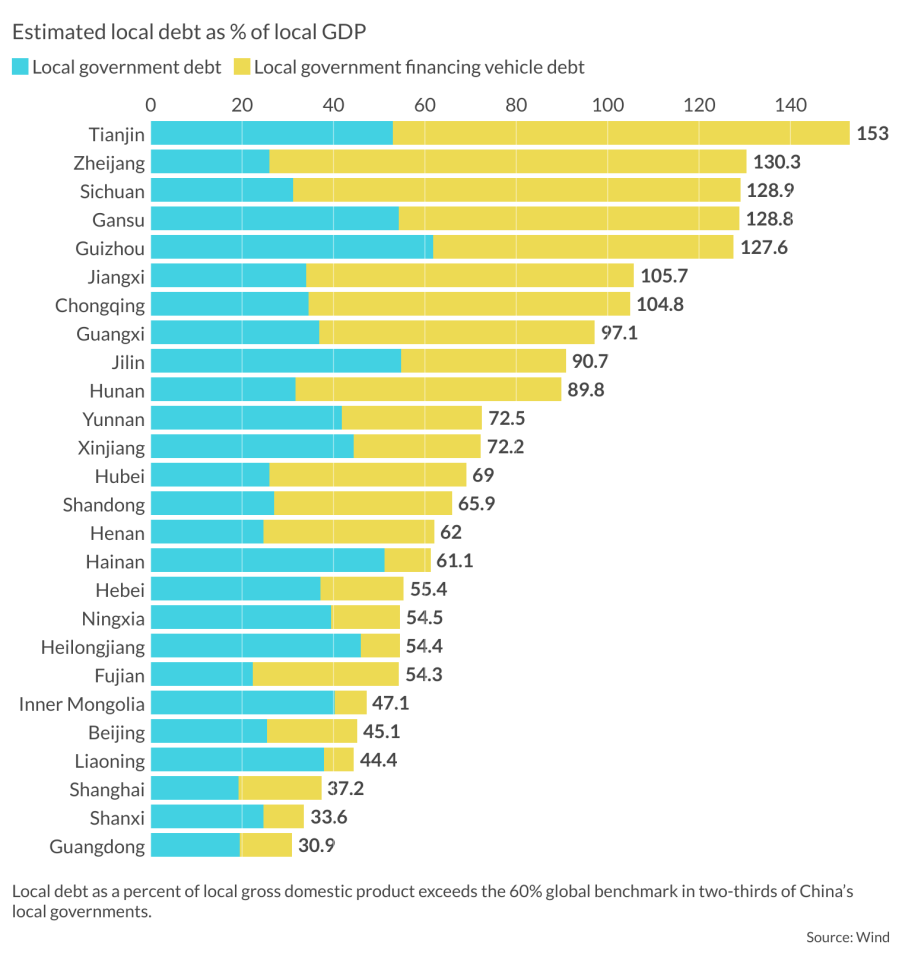

In 2021, local governments in China earned 40 percent of their total revenue from the sale of land-use rights. Local governments dramatically raise the price of land, subsequently of real estate, because they use high-priced land as collateral to get credit from local banks. Overindebtedness and an almost unrestricted increase in infrastructure projects whose economic benefits are questionable have become unavoidable. This has resulted in China’s local government debt reaching $23 trillion, Goldman Sachs estimates.

President Xi’s economic thinking is flawed in that he does not try to solve the root of the problem. Instead, he repeats slogans. Housing assets account for about 70 percent of the wealth of Chinese households, and real estate accounted for 14 percent of gross domestic product (GDP) in 2022. Once this industry slumps, the wealth of the Chinese people, especially the middle class, will shrink.

Many local governments, which used to rely on the property bubble to support their projects, have been plunged into crisis, and in some areas, even the salaries of teachers, public transportation, municipal employees or public security officers cannot be paid as a result. Currently, Chinese officials categorize 14 provinces as being in financial crises (there are 31 provinces and municipalities in mainland China).

China’s system is also flawed in the way it discriminates against private businesses in favor of state-owned enterprises (SOEs); this has been particularly obvious during President Xi’s era. Private companies are the largest contributors to GDP, employment and exports in China. According to general estimates, China must have 6 percent GDP growth to keep its existing labor force employed. Treating private companies well is the biggest prerequisite for achieving such growth.

But Mr. Xi is convinced that SOEs are the “pillars of socialism” – an important aspect of his economic theory. That is why the government has invested so much in SOEs through credit and subsidies. As a result of the discrimination against private companies, including a crackdown on the tutoring industry and counseling sectors, unemployment has risen dramatically in China. The employment rate of graduates has plummeted while disposable incomes have declined significantly, damaging purchasing power. The result is deflation and a lack of confidence in the state.

Facts & figures

An antiquated view of the economy

China’s economy has been in a downward spiral since the end of the zero-Covid policy on January 8, 2023. The root of the degradation is the lack of a consistent, holistic, market-friendly and rule of law-based policy.

President Xi is a typical authoritarian leader who does not put the well-being of his citizens first. For example, Chinese Communist Party (CCP) officials have repeatedly rejected the practice of “giving money to the population to stimulate consumption.” In fact, if the Chinese government would transfer 1 to 1.5 percent of GDP to households, China’s economy could grow significantly. Mr. Xi’s promotion of SOEs at the expense of the private sector reflects his rigorous adherence to antiquated Communist Party principles and is a violation of basic economic understandings, despite his having a PhD in economics. One of Mr. Xi’s advantages, however, is that he can abruptly change course and follow the advice of professionals, once the whole economy is in great danger. The most obvious case was his abrupt discontinuation of the zero-Covid policy that he had championed. Seeing that China’s economy was failing dramatically, he suddenly and without any explanation reversed course in 2023.

Facts & figures

When will the ‘ticking time bomb’ explode?

United States President Joe Biden recently called China’s economy a “ticking time bomb’’ that could explode at any moment. This would have a huge negative impact on the world. China’s economic growth accounts for about 30 percent of global economic growth. But there are various reasons to assume that China’s time bomb will still be ticking for quite some time.

First, there is a sense of vigilance in China’s authoritarian system. The survival of the Communist Party is its overriding principle. When the ruling party feels threatened, the CCP under its leader will take all measures to rescue itself. However, there are some problems it cannot solve. There is an abundance of temporary solutions in the CCP’s toolbox, such as China’s recent plan to allow local governments to issue 1.5 trillion yuan in special financing bonds aimed at helping 12 regions to repay their debts. Temporary solutions might be a last-minute lifesaver. Yet they are hardly sustainable.

The Chinese economy does have potential remedies. Local governments are cash-starved but asset-rich. In 2021, the net assets of nonfinancial SOEs amounted to 76.6 trillion yuan. If Mr. Xi could change his mindset from only favoring SOEs and instead seek to privatize some state-owned assets, he could resolve some of the problems of underconsumption and the weakness of private enterprises.

China is also rapidly improving its scientific research capability. The country has become a leader in new industries, like electric vehicles and renewable technologies. Artificial intelligence, digitization and biomedicine are also booming. Still, these developments will only slightly remedy China’s unemployment problem. They also will not do much to strengthen the purchasing power of the population.

China is facing “a situation worse than anything it has seen in more than 40 years,” according to prominent analyst Wang Wen. Societal tensions, for example, have triggered more than 140 strikes in factories across the country in the first five months of 2023, according to China’s labor newsletter. Beijing retains the tools at its disposal to suppress the uprisings, at least temporarily.

In short, Mr. Xi is unwilling to promote economic liberalization at the institutional level. He does not have a sustainable program. He also lacks the insight and courage of former Chinese Premier Zhu Rongji to make painful reforms to the nonmarket system, especially the state-run enterprises. In other words, in the framework of China’s existing economic model, it is useless to expect any big turnaround. China’s economic downturn is inevitable. Western companies must be prepared for it.

Chinese authorities have intentionally made their economic data opaque. For example, the Chinese government has ceased releasing data on the unemployment rate for people between the ages of 25 and 59. This opacity and uncertainty do not favor foreign businesses in China. Foreign direct investment in China has now been knocked down to its lowest level as a percentage of GDP since 1990.

According to a poll by the European Union Chamber of Commerce in China, one in 10 companies is moving its investments out of China, while one in five is delaying or considering withdrawing its investments. The same survey showed that two-fifths of Chinese customers or suppliers are moving investments out of China.

Scenarios

The touchstone of the economy is real estate. This sector has a direct relationship with the consumption of Chinese people and the development of industry. China’s current real estate problems ultimately cannot be resolved. Excess housing remains an untreatable disease, thus the nation’s economy will gradually go downhill. China will not be able to get out of the “middle-income country trap” because of a decline in purchasing power.

The worst scenario: President Xi’s image of greatness is fast losing its luster. If China’s current set of desperate measures do not work, then a diversion, through something like attacking Taiwan, or igniting conflicts in the South China Sea, becomes a very likely way out. China, after all, has more military capability now than ever before.

For industry-specific scenarios and bespoke geopolitical intelligence, contact us and we will provide you with more information about our advisory services.