Cheap is over: Good and bad news for eurozone banks

Eurozone banks must reinvent themselves as the European Central Bank tries to “normalize” its monetary policy within a still abnormal macroeconomic environment.

In a nutshell

- The ECB’s monetary policy shift in 2022 changes the game rules for banks

- Rising interest rates will improve the eurozone banks’ loan income

- The ECB will stop offering banks funding at very attractive conditions

Since the summer of 2022, the European Central Bank has raised its key interest rates four times. The deposit facility rate, the rate for main refinancing operations, and the one on the marginal lending facility now stand at 2 percent, 2.5 percent and 2.75 percent, respectively. Further hikes are expected for the coming months if inflation continues its rapid rise. This shift in monetary policy has significant consequences for eurozone banks.

Over a decade of ultralow and even negative rates, which had weighed heavily on their profitability, has ended. But does it mark a return to a long-forgotten pre-2008 crisis “normal”? No one can say for sure.

Staying sane in an insane world

In the aftermath of the global financial crisis, the negative interest rate policy was promoted as the ultimate wonder weapon to get growth back on track. At the time, elite economists from the International Monetary Fund even pushed for “deep” negative rates to fight the Great Recession.

In many ways, that theory was flying in the face of common sense. In an ordinary monetary world, interest is the money you owe when borrowing or receive when lending. Likewise, commercial banks would earn interest when they park cash with their central bank. In a world of negative rates, it is the other way around. Under such circumstances, borrowers should be able to find a mortgage that pays them interest, whereas savers must pay a fee to the bank that lends out their money. Banks, for their part, are taxed on their deposits at the central bank.

The economists advising the ECB back then claimed that hoarding wealth was the enemy of economic growth.

Supposed to be an exceptional response to exceptional circumstances, a negative interest rate policy was finally practiced for many years, notably by the ECB. The idea behind this awkward monetary policy experiment was to create incentives for commercial banks to reduce their unspent balances, lend more money to the economy, and for their customers to invest, lend or spend their money rather than hoard it.

Setting money aside is what individuals and businesses tend to do, especially in times of low inflation and deflation. Over the past decade, the euro area has been stuck in such a situation. For years, annual inflation did not come anywhere near the ECB’s 2 percent target. By the end of 2020, monthly rates had even fallen into slightly negative territory.

The economists advising the ECB back then claimed that hoarding wealth was the enemy of economic growth. They argued that it aggravated the long-standing problem of insufficient aggregate demand, leading to ever more stagnation. The proposed remedy was to penalize savers.

Greasing the wheels

Negative rates had a profound impact on banking activity. First, one of banks’ primary sources of income was gradually eroded, and previously profitable business strategies were suddenly no longer viable.

Moreover, in the aftermath of the financial crisis, eurozone banks had to adapt to stringent, complex and costly regulatory requirements imposed on them amid chronically weak macroeconomic and financial conditions.

While some banks successfully reshaped their business models, others still struggle to boost their profits. In particular, that is the case for smaller commercial banks that mainly have household and small business deposits, hence a limited pricing power and adjustment capacity. Yet, these banks play a sizable role in financing and developing local economies and in the transmission of monetary policy.

The ECB has been attentive early on to the issue of bank profitability. In 2014, it decided to compensate lenders for their loan losses due to depressed interest rates. In return for customer-friendly lending policies, banks were offered funding at very attractive conditions through a series of so-called Targeted Longer-Term Refinancing Operations (TLTRO I in 2014, TLTRO II in 2016 and TLTRO III in 2019).

In 2020, following the outbreak of the coronavirus pandemic, TLTRO III operations became even more favorable for banks. The purpose was to encourage them to substantially lower their credit standards for lending, notably to small and medium-sized enterprises (SMEs) and distressed households. As of May 2021, the total TLTRO-III program reached an impressive size of 2,080 billion euros. According to ING, 425 banks benefited from this windfall during the second pandemic year, with an average allocation of 780 million euros per bank.

Drowning in money

It rapidly became apparent that low policy rates alone would not suffice to revive the chronically frail euro area economies. That is why, in early 2015, the ECB came up with a range of new unconventional accommodative monetary policies grouped under the label “quantitative easing.”

For the most part, they consist of buying massive amounts of government and other debt. Over the years, a panoply of asset purchase programs, one more ambitious than the other, allowed the central bank to inject trillions of euros into the eurozone economy.

Zombie firms and, behind them, stressed banks are a scourge from whose effects the euro area economy will suffer for a long time to come.

This massive and constant liquidity provision helped attenuate the macroeconomic impact of a seemingly unending series of major global shocks hitting the bloc between 2008 and now. According to British historian Robert Skidelsky, the ECB’s aggressive policy actions “did some good,” but the problem was that the sellers of the bonds it purchased en masse “mostly sat on the cash instead of spending or investing it.”

Listen for more on this topic

Road of excess

Other unintended consequences did not take long to jeopardize the ECB’s by-then permanent anti-crisis plan.

By keeping interest rates ultralow for a prolonged period, monetary authorities created false price signals in markets, exacerbating what the Austrian business cycle theory calls “malinvestments.” Zombie firms and, behind them, stressed banks are a scourge from whose effects the euro area economy will suffer for a long time to come – even more so now that interest rates are rising.

Over the years, cheap borrowing has led to an explosion of corporate, household and, above all, government debt. By the end of the second quarter of 2022, despite a slight improvement compared to the peak of the pandemic, high ratios of government debt to gross domestic product (GDP) could still be observed in Greece (182.1 percent), Italy (150.2 percent), Portugal (123.4 percent), Spain (116.1 percent), France (113.1 percent) and Belgium (108.3 percent). Spanish economist Daniel Lacalle rightly observed that “depressing the price of risk is a subsidy to reckless behavior and excessive debt.”

Because of declining profits, banks, too, were encouraged to take bigger risks. So were savers, frustrated by years of financial repression. Some were tempted by ultra-high-risk sectors such as cryptocurrency, and others considered investing in less risky assets, like real estate. Over the years, the artificially low cost of credit helped inflate asset bubbles everywhere in Europe. For example, in the Netherlands and Luxembourg, housing has become unaffordable even for well-earning middle-class families.

Facts & figures

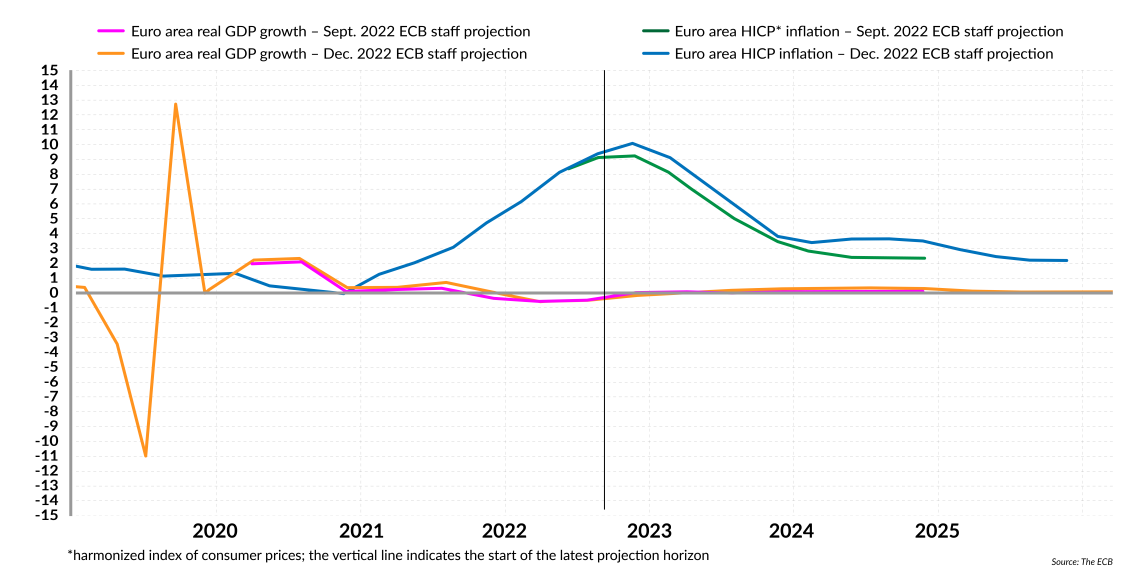

2023 and beyond: Euro area projected inflation and GDP growth

In retrospect, the negative interest rate wonder weapon is increasingly viewed as a policy error of historic proportions. Unable to solve the growth problem it was primarily designed for, it created a myriad of new ones.

Lags or cold expropriation?

Eurozone banks have woken up to a new world in 2022. They must reinvent themselves in a context where the ECB is trying to “normalize” its monetary policy within a still completely abnormal macroeconomic environment.

This time, near-zero growth rates contrast with soaring inflation rates – clearly not a healthy situation. By the end of 2022, the eurozone inflation was around 11 percentage points higher than it was by the end of 2020. Even ECB Vice-President Luis de Guindos conceded that “since the start of the monetary union, we have not witnessed such a rapid shift in the inflation environment.”

Mr. de Guindos is confident that the ECB’s recent interest rate hikes will “support a timely return of inflation to 2 percent.” But he also notes that the overall impact of the current policy tightening will be visible only with “the usual lags.”

As long as interest rates lag behind inflation, the purchasing power of workers and pensioners, consumers and savers, will continue to weaken.

These lags are the crux of the problem. Currently, the ECB’s relatively moderate interest rate increases are far from being in line with the dramatically rising prices in the eurozone. They are too little too late and, as many point out, still in the monetary policy’s neutral, not tight territory.

As long as interest rates lag behind inflation, the purchasing power of workers and pensioners, consumers and savers, will continue to weaken. Financial repression or, to use a more powerful term circulating in the German-speaking press, die kalte Enteignung (cold dispossession), is taking on a new dimension.

Bright spot

For banks, the situation may appear more favorable this time. Rising interest rates will help them make their core activities more profitable again, at least in the short term. Benefitting all at once from higher rates and post-pandemic credit growth, many banks have seen their net interest income improve significantly by the end of 2022.

As the ECB’s latest Bank Lending Survey reveals, loan demand has indeed continued to rise in the third quarter of 2022, notably for enterprises. It is nonetheless plummeting for households – precisely because loans are getting more expensive.

Moreover, a large proportion of the about 140 banks that participated in the survey indicated that they will now tighten their loan approval criteria for all clients – be they ordinary consumers, SMEs or large firms. As the eurozone is presumably heading into recession, banks’ risk tolerance is likely to fall even lower throughout 2023, the report concludes.

That could quickly put indebted households and companies in a delicate situation. Banks, on their side, will have to account for more loan losses in the coming months.

Debt-stricken governments will be facing new challenges too. On the one hand, soaring inflation shrinks their debt, but on the other, higher borrowing costs could accelerate their approach to the cliff.

Much will depend on whether banks have learned the lesson from the 2009-2012 European debt crisis. At the time, significant holdings of their governments’ debt had exposed them to severe losses when the latter’s finances came under pressure. Sovereigns and domestic banks ended up drawing each other into the abyss.

Today, eurozone banks have more robust capital positions and larger liquidity buffers than they had back then. But they also face a range of new difficulties.

Scenarios

Wind of rebellion

For starters, the competitive pressure from financial technology companies and big tech firms is increasingly hurting their profitability. In the near future, the ECB also could upend banks’ world by launching a “digital euro.” Central Bank Digital Currencies (CBDCs) from other nations, such as China, eager to impose themselves in Europe, could make things even more complex.

Geopolitics has definitely entered finance. As the ECB’s latest Financial Stability Review cautions, aging information technology systems make traditional banks vulnerable to foreign cyberattacks that are getting ever more sophisticated thanks to artificial intelligence and self-learning malware.

According to Andrea Enria, chair of the ECB’s Supervisory Board, banks would be naive to assume that “navigating geopolitical shocks will be as smooth as the recovery of the pandemic.”

During the past years of permanent crisis, banks received much support from the ECB – to the point that they ended up regarding this help as an entitlement of sorts. But now the age of “exceptional blanket measures” is over, the chairperson warned.

Mr. Enria is concerned that banks’ overoptimism bias is worsened by their expectation that rates will continue to rise in 2023 and guarantee them further increases in net interest income.

Interestingly, a wind of rebellion against the ECB is blowing through the European banking sector. Several bank bosses have become vocal against what they perceive as “increasingly intrusive behavior” from their supervisor. Restricted shareholder rights, more stress-testing, more capital and reporting requirements, more surveillance and even the presence of an ECB observer in their board meetings – are becoming too much for them.

This nascent protest movement could signal that, after almost 15 years of regulatory paternalism and persistent policy failures, eurozone banks feel the need to fend for themselves.