Policymakers are mishandling the eurozone’s inflation

ECB officials and government policymakers in the euro area are groping in the dark for an effective price inflation policy.

In a nutshell

- Central banks are no longer sure how to respond to growing inflation

- The current inflation policy serves governments, not the economy and society

- The problem of price inflation is on the side of supply, not excessive demand

Central bankers and politicians responsible for inflation policy are at a loss: their forecasting models have let them down and they are sailing in allegedly uncharted waters. Despite much drumbeating about the virtues of “forward guidance” (announcing policymaking measures in advance so that operators can adjust in time), this expression now means that monetary policy is erratic and driven by the latest available figures. The eurozone is no exception.

Although groping in the dark often seems to be the name of the central bankers’ favorite game, two deeply-rooted beliefs remain.

Contradicting themselves

First, conventional knowledge holds that fighting inflation requires cooling off aggregate demand, which in turn calls for higher interest rates. However, this narrative stokes growth fears since many believe lower aggregate demand leads to lower gross domestic product (GDP). That explains current ambiguities: sometimes we are told that fighting inflation will not dampen growth, and sometimes it is claimed that inflation has priority and that recession could be an unfortunate possibility. The balance between the two positions depends on the latest news.

The second belief regards the self-propelling wage-price spiral that seemingly makes taming inflation so hard. In simple words, it is argued that rising prices induce workers to demand higher wages, that higher wages add to production costs, and that these higher costs generate a rise in prices. Within this framework, therefore, inflation would never stop.

The good news is that both beliefs are flawed. And the bad news is that by sticking to these narratives – the crucial role of aggregate demand and the cost-price spiral – policymakers are making things worse. In this light, the remaining part of this report pursues three goals: it recalls some basic economics, describes why present policymaking is harmful and outlines what we can expect in the future.

The demand side

Most 18th-century authors pointed out that lack of demand is never a problem. Human nature is such that we always want to consume more and better goods. Indeed, economics is not about scarce demand but scarce supply. We are not better off when our wants increase but when we can buy more: it is what happens when innovation, technological progress and entrepreneurial skills weaken the scarcity constraint. As a result, greater productivity generates more purchasing power. That summarizes the history of economic growth during the past two centuries. It also explains why efforts to boost aggregate demand are pointless.

It is essential to know that the spiral is not the root of the problem but rather the consequence of scarce supply and monetary promises.

Of course, it does happen that producers get things wrong, make unwanted goods and fail to deliver goods that are in high demand. In these cases, and absent government intervention, loss-making production is abandoned, and resources are redirected to profitable areas. That is the essence of a free-market environment.

In particular, there is no need to encourage consumers to buy what they do not like or prevent companies from redirecting their production capacities. Instead, if policymakers believed that the money consumers and investors are spending is an illusion and represents no real purchasing power, they would do better to consider the origin of that illusory purchasing power, not worry about people’s preferences.

Cost-price spiral

Similar comments apply to the cost-price spiral. Inflation means that too much money is chasing too few goods. Of course, some people are disappointed because they can buy less than expected. In particular, either people thought they could buy more and feel frustrated, or their expectations were more or less stable, but they find out that the amount of goods available has diminished. That happens, for example, when resources are employed in relatively less valuable projects (malinvestments), productivity drops, or debts must be paid back, and part of the production goes to creditors.

In all these cases, people fight to preserve their purchasing power at somebody else’s expense. Tensions might emerge. Yet, it is essential to know that the spiral is not the root of the problem but rather the consequence of scarce supply and monetary promises.

Roads to nowhere

When central bankers manipulate aggregate demand, they pursue four strategies following political pressure and demagoguery. They may choose to do one of four things:

- Change the composition of demand, which can be accomplished by altering the price structure through taxes and subsidies

- Destroy the illusory purchasing power (excess money) that originates “excess demand”

- Create new illusory purchasing power in the hope that producers would react by increasing supply

- Redirect resources toward loss-making ventures in an effort to create, as they insist, jobs and “added value”

Regrettably, all these measures have been undertaken in recent years. The results are apparent: inconsistent aggregate-demand policies that share one common feature, namely – improvising in hopes that money printing and negative interest rates somehow would cover the mistakes generated by ignorance and promises to provide infinite free lunches. Perverse consequences followed.

Supply, stupid

Likewise, the cost-price spiral is problematic indeed, but not because rising wages keep prices under pressure. Instead, the problem is that many companies go broke if rising wages end up squeezing profits. If new and more efficient companies do not show up, production drops, prices rise and tensions emerge. Of course, in that case, the issue is not “weak demand” but “weak supply.”

The legacy of the past will keep driving prices up and tempt politicians to come to the rescue by subsidizing companies or workers.

Understandably, this is not the kind of narrative that policymakers and central bankers in Brussels and Frankfurt like to hear. That may explain why they will likely continue to pursue a wait-and-see approach and why their scheme of action – or lack of it – might fail to bring inflation under control.

The presses continue running

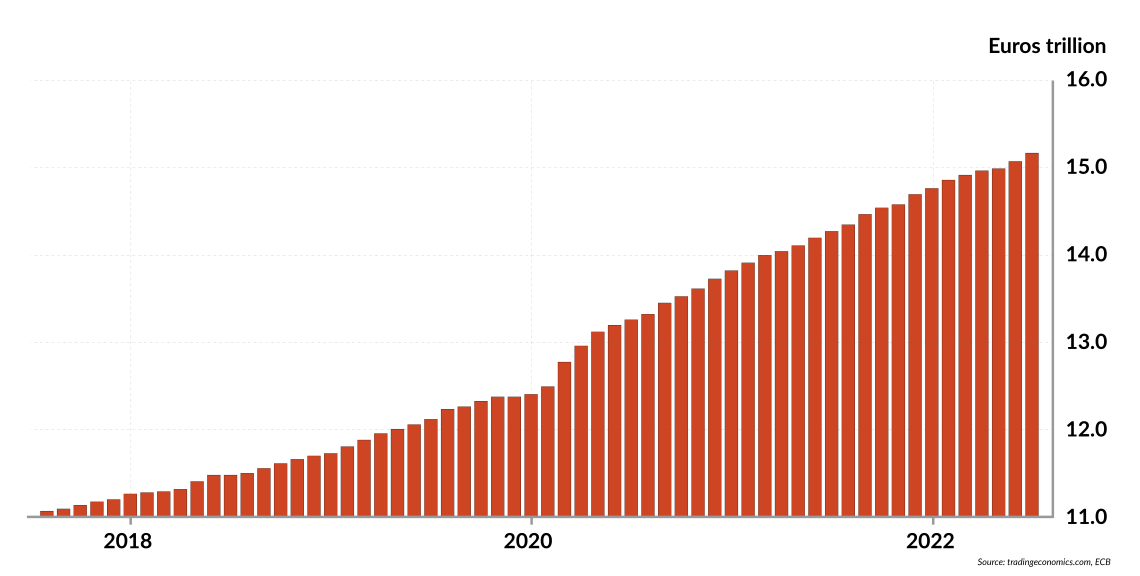

Although the growth rate of the money supply in the euro area has recently slowed down, “money printing” has not ceased. For example, M2 money supply has risen to about 15.1 trillion euros in July 2022 from 14.9 trillion euros in May 2022.

Facts & figures

The euro area monthly money supply still expands

Thus, the legacy of the past will keep driving prices up and tempt politicians to come to the rescue by subsidizing companies or workers, who would then abstain from asking for substantial pay raises. The budget deficits mean higher public debt and ongoing intervention by the ECB, which is eager to avoid a public-finance crisis and ready to finance selected borrowers through renewed money printing.

Scenarios

Socialist regulation, nationalization

Eurozone politicians may try to dampen the rise in prices by introducing price caps or other forms of regulation (e.g., rationing, populist labor-market legislation). However, these measures will encourage companies to shut down or relocate, and GDP will suffer. If the domestic authorities react by engaging in nationalization programs (allegedly to save jobs), GDP will suffer even more. Once again, supply is the critical issue, and efforts to manipulate demand eventually hit supply.

Bowing to the free market

A second possibility is that the EU switches to supply-boosting policies, increasing GDP and easing inflationary tensions. A supply-side policy implies creating an environment that makes life easier for the entrepreneurs: efficient judiciary and bureaucracies, light regulation and low taxation.

This may be a pipe dream. An EU supply-boosting policy would also likely mean more transfers from Brussels and Frankfurt to the national lawmakers. An expanded Recovery and Resilience Facility, or NRRP, to mitigate the economic and social impact of the coronavirus could be a good example here. The eurozone authorities pretend that NRRT is a supply measure to enhance efficiency and productivity, but in fact it is a demand policy that gives the political leaders more money to spend. If so, the outcome would be inflation (more money printing to finance the new program) and an ongoing transfer of resources from the private (productive) sector to the (inefficient) public sector.

More fiscal repression

Finally, one should not forget that the temptation to increase tax pressure is hard to suppress. Higher taxes can be presented as an effort to fight tax evasion and profit-shifting or to bring about a fair tax system. Indeed, higher taxes can kill part of illusionary purchasing power and stifle price inflation’s momentum. Yet, one wonders whether this is the best way of draining liquidity and a reasonable substitute to sound monetary policy.

Indeed, and consistent with our earlier remarks, one suspects that calls for higher tax pressure and more stringent regulation of all kinds are simply ways of transferring resources to the public sector at the expense of private companies. If so, the future for Europe is grim.